ILU has been under pressure on two fronts in 2024, and it’s easy to question whether we are in the eye of the proverbial storm with our recent purchase!

The company announced an update on its Eneabba Rare Earths project (EP3), securing additional funding of A$400m from the Australian Government (AusGov). The company also plans to contribute a further A$214m in cash, with any potential cost overruns shared with the AusGov on a 50/50 basis – the market was expecting/hoping for a better outcome for ILU and the stock was hammered accordingly. The project funding update clarifies uncertainty about the project’s go-ahead; the key focus will now be project execution and long-term rare earth market fundamentals.

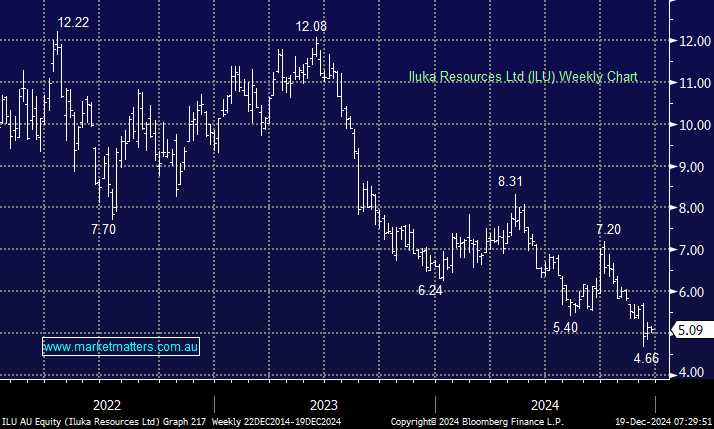

- We see a valuation upside to ILU after the recent share price drop, with shares trading at a four-year low, but it’s not for the fainthearted.

Over 30% of ILU’s revenue came from China in 2023, and any semblance of recovery by the China property market will significantly improve its traditional minerals sands operations, which have been under pressure in recent years – ILU is a leading producer of zircon, primarily used in ceramic floor and wall tiles and high-grade titanium dioxide feedstocks (rutile and synthetic rutile) used in paints, hence the obvious correlation to China’s weak property market.

- We like the risk/reward towards ILU around $5, but our position is causing discomfort – MM holds ILU in our Active Growth Portfolio.