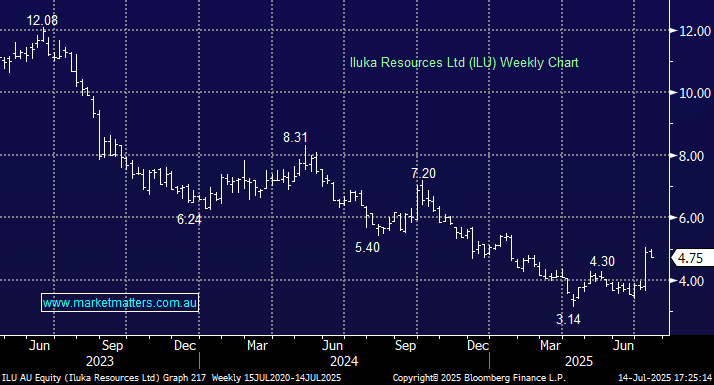

This mineral sands and rare earths company has been weighed down by persistently weak demand primarily out of China due to its much discussed embattled property market. However, ILU does have future exposure to rare earths and it was this that propelled the stock up almost 30% last week following the DoD’s move into MP. ILU is aiming to construct a fully-capable rare earths refinery to serve light and heavy rare earth markets, supported by government funding and strategic offtake agreements, but costs have already blown out by a whopping ~50% and commissioning has slipped by up to 2 years, mainly due to design revisions, funding negotiations, and regulatory steps; first production is now forecast for 2027. Buying ILU for rare earths exposure is still a leap of faith, albeit a smaller one than a few years ago.

- We like ILU but prefer purer rare earth plays at this stage of its evolution. That said, ILU does look to have taken its medicine around its Eneabba rare earths refinery.