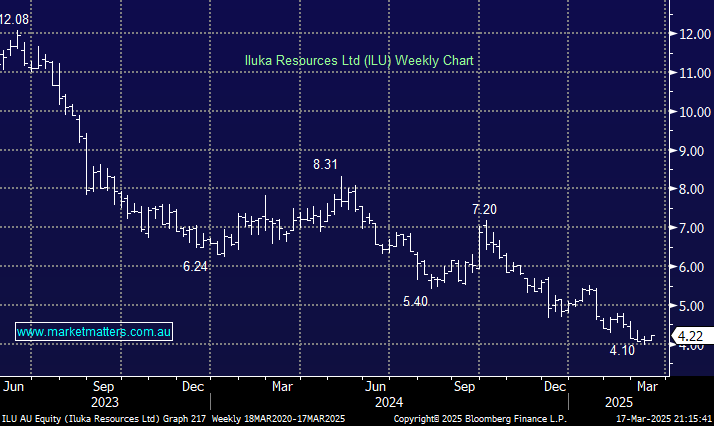

Iluka (ILU) rallied +3.2% on Monday, with the rare earth/mineral sands business enjoying returning optimism towards China. ILU remains a leveraged demand story, primarily around China’s beleaguered property market. After plunging over 65% from its 2023 high, there’s plenty of room for at least a bounce, i.e., the stock should recover when things turn for China’s ceramic industry (the property market). We are not enamoured with this position, having picked the turn too early, and will consider cutting it above $5, our ideal “bounce” target over the coming months.

- We will watch ILU carefully this week as China-facing stocks enjoy a bid. MM holds ILU in our Active Growth Portfolio.