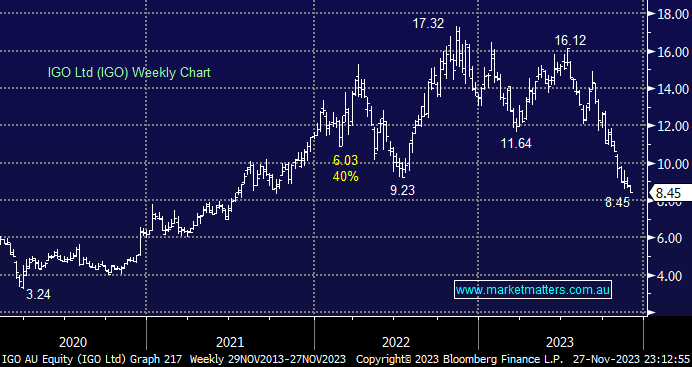

Last month’s 1Q update for the nickel and lithium company wasn’t well received by the market, which is not good news when combined with an underlying commodity in freefall – EBITDA fell 42%, mostly on the back of lower profits from their Tianqi Joint Venture which was impacted by weaker lithium prices while nickel production was also an issue with both Forrestania & Nova seeing production fall more than 20% vs 4Q23, plus it was noted that TLEA wouldn’t be taking their full lithium spodumene allocation from Greenbushes which will have a double-whammy impact on IGO earnings. The net result for MM is simple: IGO is not our preferred stock to play a recovery in the Lithium Sector.

- Fortunately, we sold out of IGO late in 2022 taking a 50% profit at $15.99 then tidied up our remaining position earlier in the year at $13.61 (~30% profit) for the Active Growth Portfolio, indicating there are at least two core components to successful investing buying and the often-forgotten selling.