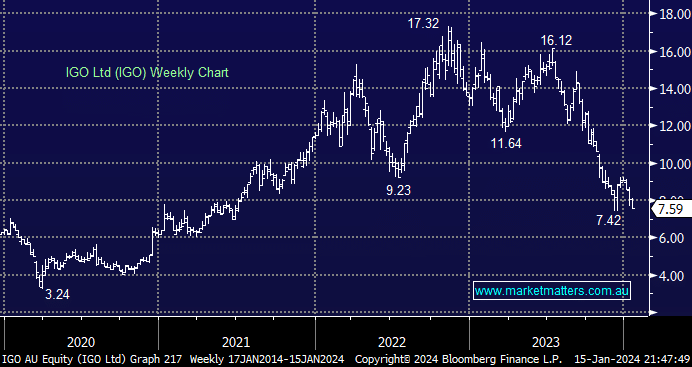

Lithium and nickel company IGO has more than halved from its 2023 high after writing off almost $1bn from its Western Areas (WSA) acquisition only one year from paying $1.3bn for the nickel miner – hard to imagine getting this anymore wrong. Combined with the collapsing lithium price, bear market in nickel and WSA debacle, things look about as bad as they could for IGO, often an interesting time! We can see a washout sell-off towards $7, which may see MM start accumulating this ESG stock.

- We like the risk/reward towards IGO below its 2023 $7.42 low.