How is the venture capitalist community thinking about technology?

We read an interesting piece of research published by UBS this week following their 2-day VC conference where a bunch of well-regarded firms discuss emerging enterprise technology trends, the companies that these VC firms have invested in and the impacts these trends may have on publicly traded software stocks. All big picture and all not directly correlated to actionable ideas here and now, but as investors, it’s important to be across where the money is going, and what technologies have momentum, so we don’t end up owning a stock like Appen (APX) – our past views on that stock can be read here for those interested.

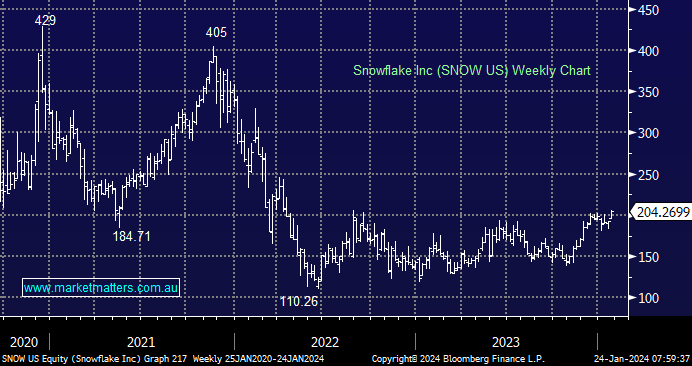

While there is a lot to write on the private side of things, that’s not MM’s domain, however, each of the VC partners (14 in total) was asked to cite 1-2 publicly-traded software stocks that in their judgment were strong businesses with strong long-term potential. Crowdstrike (CRWD US) was the most frequently mentioned, followed by Snowflake (SNOW US), a stock we already own in the International Equities Portfolio having bought it late in 2022 at US$140.56, 3rd was Datadog (DDOG). Among the larger “established” stocks, Microsoft (MSFT US) which we also own was flagged as expected but this year, UBS was struck by the positive mentions of Salesforce (CRM US) and Oracle (ORCL US), the latter (along with Microsoft) is heavily exposed to the cloud which is being underpinned by the massive investment happening in AI.

Concern around a global slowdown over the past 1-2 years has clearly not materialised, and when slowdowns happen, companies tighten their belt and spend less developing new and innovative things. A year ago at this event, there were signs this slowdown was happening, particularly in the 2H22, however, a year later, the tone has now clearly changed – overall demand has noticeably improved, with every VC firm calling out stabilisation in the sales of their portfolio companies and several suggesting that demand might even be improving – a sort of “stable with a clear hint of improvement” message is the takeaway.

- The US is the leader in technology & innovation, and at no time in history will these areas be more important as AI continues to evolve and attract massive investment.

At MM, we often write about our sector views, upweighting and downweighting different areas within portfolios, important in our active approach, however, we are also continually thinking about the future and how we can add value to portfolios by holding those companies with big runways for growth – Snowflake being a clear example today.

- MM remains very open-minded about emerging technology trends as they evolve year to year.