GQG is an active manager that has attracted capital based on strong investment returns in recent years. For example, their main global-focussed fund returned 20.71% in CY23, which underpins the manager’s strong organic growth prospects, much better than PPT’s bid for growth through its questionable purchase of Pendal. The markets looking for ongoing strong net inflows to continue in 2024 and on an est. PE of ~12x for 2024 and an expected yield of over 6%, this manager looks solid value as it goes from strength to strength.

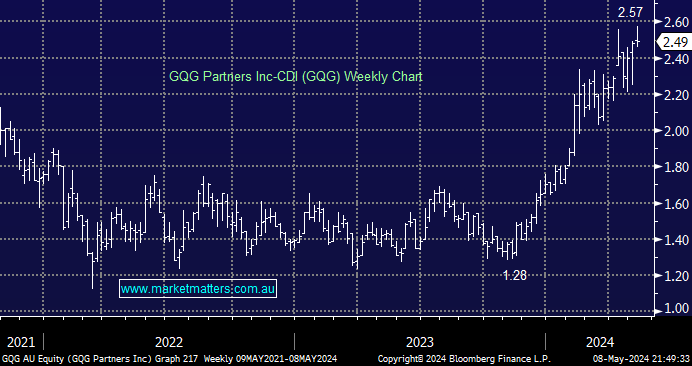

- We like GQG, especially into dips back towards $2.20, around which it’s been rotating of late.

GQG operates in the same space as “Active Investment” space as MM, with very similar performance being generates vs our Active Growth Portfolio, which is open for investment – more details available here.