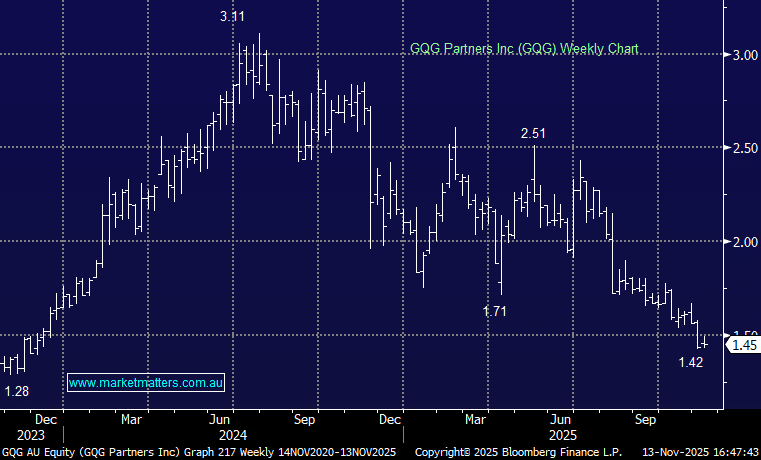

GQG flat: Released an October funds under management (FUM) update yesterday which came in at US$163.7bn, basically bang in line with expectations, but still down 2.1% for the month. The decline was split between client outflows (-1.6%) and softer investment returns (-0.5%).

The issue remains the same: another US$2.6bn walked out the door, the fourth month in a row of net outflows and noticeably higher than the quarterly average of around US$1.6bn.

Performance has been the reason for the outflows, and it again lagged through October, although early November has been much better, with roughly +2% alpha month-to-date as their more defensive positioning has started to look sensible again with AI exuberance cooling off a touch.

Despite the pressure, GQG screens very cheap – ~6x earnings and a ~15% yield – and there are still some positives:

- Positive absolute returns are helping limit the damage from outflows.

- Most redemptions are coming from the smaller, lower-margin US equity strategy, while the far bigger International strategy has held up well.

The earnings impact of these outflows is minor at this stage – it’s more sentiment thing. We still expect further outflows – probably around $2bn a month until the dial turns on performance.

If we price GQG on 10x earnings at the currency around current levels, it’s worth $2.15.