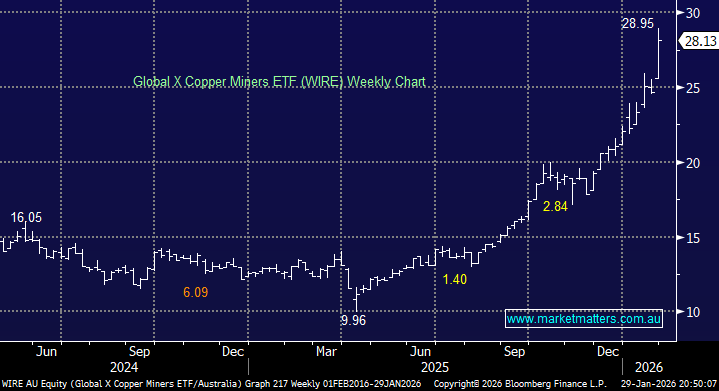

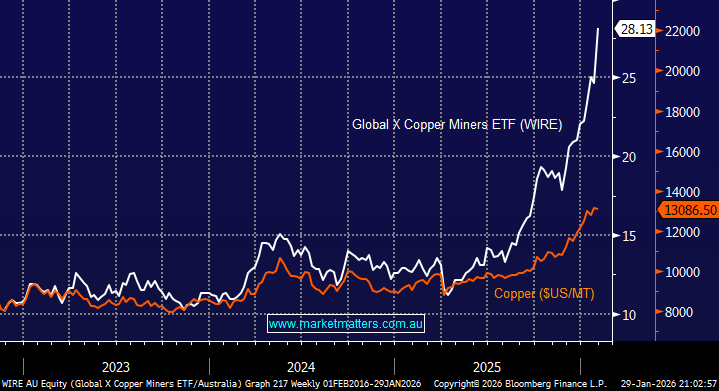

Our concern towards the WIRE ETF is how hard it’s run compared to the underlying industrial metal. For example, Cu is up +70% from its sharp sell-off last April, yet the WIRE ETF has gained more than +190% as fund managers scrambled for exposure to the coveted industrial metal. Similarly, over the same period, Sandfire (SFR) has surged +165%.

- The risk/reward “chasing” copper stocks and ETFs into the current buying frenzy is unappealing to us.

While we like the copper sector, a decent pullback wouldn’t surprise us if the industrial metal trades sideways for a while. We are in “Buy the Dip” mode as opposed to chasing strength here and now.

The ASX-listed Global X Miners ETF (WIRE) remains one of our favourite vehicles for broad-based exposure to global copper miners. Unlike precious metals, copper is driven by industrial uses, including global electrification and the AI revolution, as opposed to a mass of speculative retail money, although this is now gathering momentum. While copper has experienced a strong/volatile 12-months, being in the news a few times around tariffs, the underlying supply/demand story remains intact, with MM believing it’s a metal for the future, but investors should be patient after recent gains.

- The ETF holds 41 stocks, with its 5 largest positions currently overseas companies – KGHM Polska, Lundin Mining, Boliden AB, Sumitomo and Hudbay Minerals, but there are many positions of 4-6%.

- From a regional perspective, it has 37% exposure to Canada, followed by 10% to the US, 10% Australia, 10% China, and 7% Japan.

- It has a decent $780mn market cap, while its fees are a okay at 0.65%.

We remain firm believers in the Cu story over the coming years, but are likely to be buyers of dips and sellers of “pops” in the shorter term following the recent panic-like buying.

- We are targeting the +$30 area for the WIRE ETF over the coming weeks/months, but another $2.50-3 pullback is likely with some consolidation overdue.