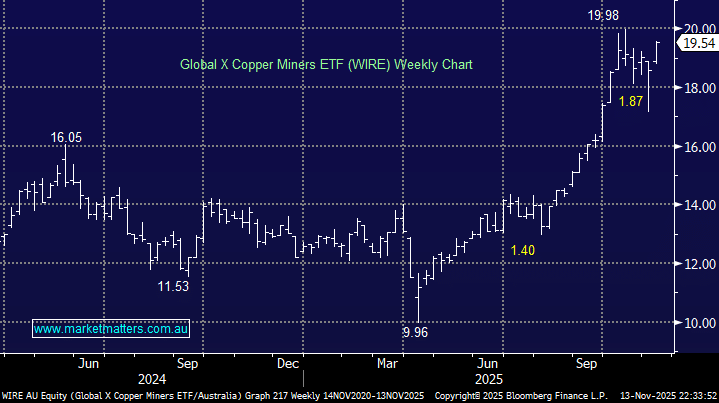

The ASX-listed Global X Miners ETF (WIRE) remains one of our favourite vehicles for broad-based exposure to global copper miners, and it’s an ETF that Shawn’s Trading Ideas has used with success through 2025. Unlike precious metals, copper is driven by industrial uses, including global electrification and the AI revolution, as opposed to a mass of speculative retail money. However, copper has experienced a volatile year, being in the news a few times around tariffs, but the underlying supply/demand story remains intact, with MM believing it’s a metal for the future.

- The ETF holds 41 stocks, with its 5 largest positions currently Boliden AB, Southern Copper, Glencore, KGHM Polska, and Antofagasta.

- From a regional perspective, it has 37% exposure to Canada, followed by 12% Australia, 10% to the US, 10% China, and 6% Japan.

- It has a decent $400mn market cap, while its fees are reasonable at 0.65%.

We remain firm believers in the Cu story over the coming years but are likely to be buyers of dips and sellers of “pops” on the trading side.

- We are targeting the $20-22 area for the WIRE ETF over the coming weeks/months.