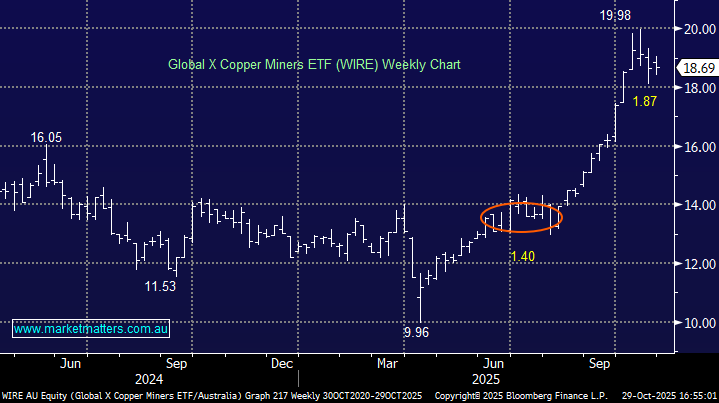

The copper (CU) facing WIRE ETF has corrected over 9% in the last few weeks, but if Cu punches up towards $US12,000/MT, as we think likely, the bull market is likely to return to town in quick fashion. For subscribers not familiar with this ETF, it holds 39 positions in global copper miners, including Lundin Mining Corp 5.8%, Hudbay Minerals 5.4%, First Quantum 5.3%, with local favourite Sandfire a 3.9% holding. We continue to rate this ETF highly, believing its 0.65% cost is reasonable considering its global access and performance/tracking; over the last year, WIRE has advanced +37.1% compared to the Solactive Global Copper Miners Index +38.2%.

- We are bullish on the WIRE ETF in line with our outlook towards Cu – We currently hold the WIRE ETF in Shawn’s Trading Ideas.