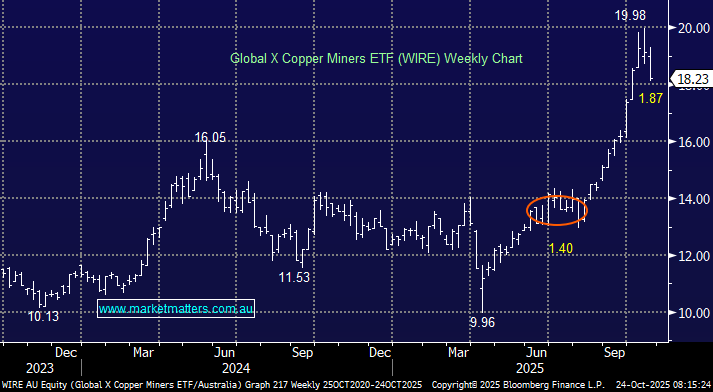

The ASX-listed Global X Miners ETF (WIRE) remains one of our favourite vehicles for broad-based exposure to global copper miners, and it’s an ETF that Shawn’s Trading Ideas has used with success through 2025. Global copper stocks have corrected over 9% from their recent high, but buying came back in last night as the industrial metal stabilised above $US5.00/lb. Unlike precious metals, copper is not driven by a mass of speculative retail money. However, copper has experienced a volatile year, being in the news a few times around tariffs, but the underlying supply/demand story remains intact, with MM believing it’s a metal for the future, as we touched on in yesterday’s AI report.

The ETF aims to track the Solactive Global Copper Miners Total Return Index. The 0.65% cost is reasonable, considering it provides easy exposure to the likes of Lundin Mining, Antofagasta and Zijin Mining, with 37% of the ETF exposed to Canada, 12% Australia & China, followed by 8% in the US. It holds 39 stocks with 5.5% in Canadian Lundin Mining Corp, its largest position. At this stage, from a risk/reward perspective, we believe the WIRE ETF is already in an accumulation zone with a few weeks of consolidation, as we saw in June/July, feeling likely.

- We believe the WIRE ETF represents great buying around $18 after its recent ~9% retracement.