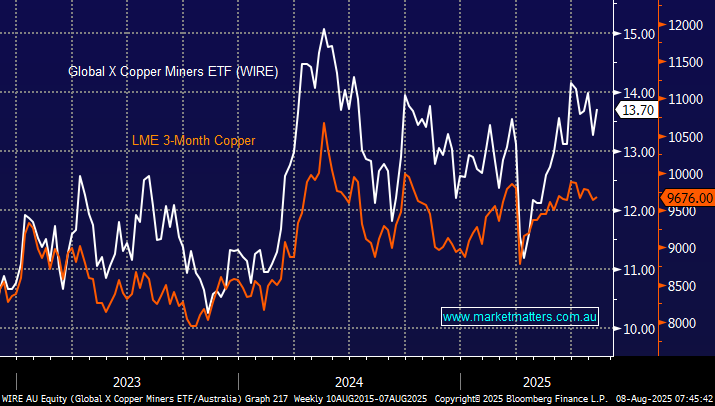

The ASX-traded WIRE ETF aims to track the Solactive Global Copper Miners Total Return Index, before costs. The holdings are spread across several countries, including Canada 36%, Australia 13%, China 10%, the US 9% and Japan 8%. Of the 40 stocks held, the five largest positions are First Quantum 5.5%, Antofagasta 5.1%, Lundin Mining 5.1%, Zijin Mining 5.1%, and Glencore 4.8% – BHP is the 8th largest position with a 4.4% weighting. The BHP holding shows this isn’t a perfect science, with its considerable iron ore exposure, but the chart below illustrates the ETF does track the copper price nicely.

- The WIRE ETF has an ok 0.65% expense ratio considering its overseas holdings, and tracks its benchmark and Cu price reasonably well, considering the lack of hedging.

The WIRE ETF is well-positioned for global electrification over the coming years, a trend we strongly believe in. The recent tariff-induced ructions around the US Comex copper price created an unorderly market, but in the long run, supply and demand will drive the base metal, and we believe this equation will prove very bullish over time.

- We like the risk/reward towards this ETF as it consolidates below the $14 area, initially targeting a retest of $16.