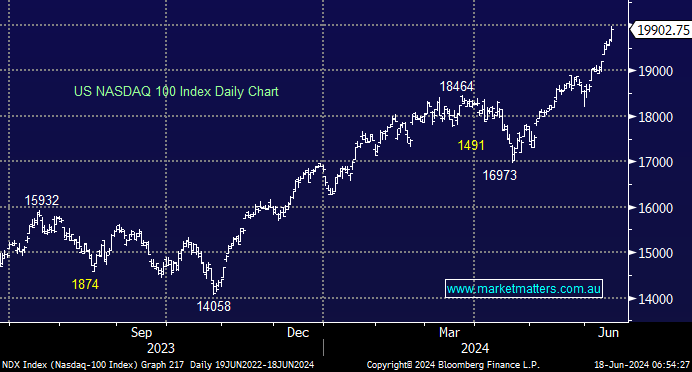

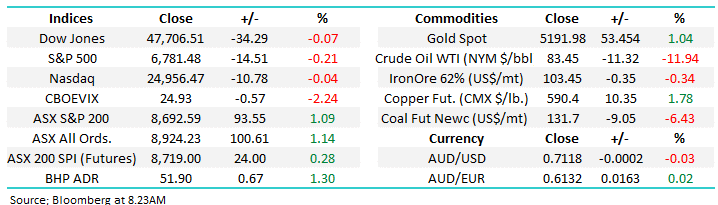

US equities pushed ever higher overnight, with the S&P500 delivering its 30th record this year despite a small increase in bond yields. US stock market gains have hardly ever been this one-sided as tech companies accelerate higher while other risk assets largely tread water. Stock traders were unwilling to sell in a thin market with Juneteenth National Independence Day being celebrated on the 19th – we could see something similar into the EOFY. It was also encouraging to see default rates retreat in May as the US economy remains solid, and a few rate cuts and corporate America could be cheering – Leveraged loan defaults slipped below 6% for the first time this year.

- The Tech-based NASDAQ is accelerating on the upside, looking increasingly bullish by the day.

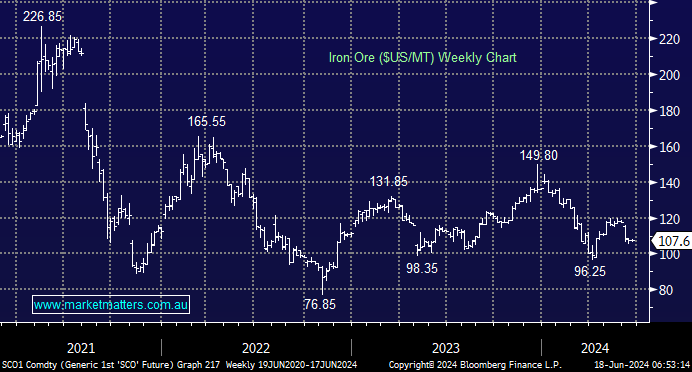

Iron ore fell yesterday following disappointing Chinese economic data, but encouragingly, it reversed higher over the session to close positive, near its intraday highs. The bulk commodity has rotated around the $US120 area for the last two years, and an extension of this consolidation wouldn’t surprise.

- We believe iron ore is likely to continue its volatile consolidation between $US80 and $US140 over the coming years.