US equities were quiet overnight with no standout leads; tech managed to offset a drop in the energy names, and a +0.1% gain by the S&P says it all. As we alluded to on Monday, with no meaningful lead until Friday, it could be a quiet week for the broader market. Manufacturing data came in weaker than expected, which sent bonds higher and yields lower, but it wasn’t enough to excite stocks ahead of Friday. It’s not surprising that stocks are struggling to push higher when the negative/cautious rhetoric out of Wall Street continues with a great example crossing our screens this morning:

“Profit margins are peaking, topline growth is weakening, net interest expense is set to move back up, valuations are rich, and sentiment/positioning are near highs.” – JP Morgan.

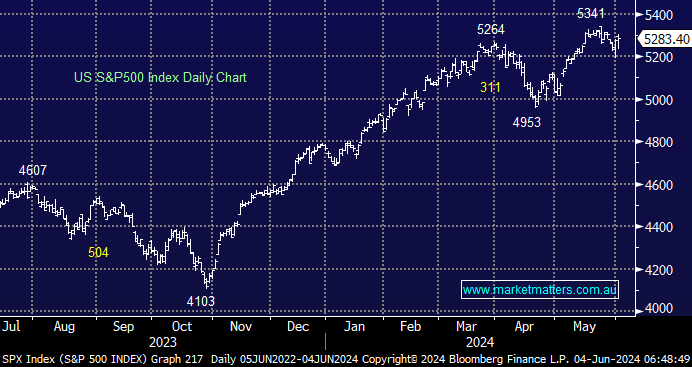

- Over the coming weeks/months, our ideal target for the S&P500 is ~5500, but it’s clearly comfortable around 5300 ahead of Friday’s employment data.

Brent crude plunged -3.5% overnight following the surprise announcement from 8 OPEC members, led by Saudi Arabia and Russia, that they would start phasing out 2.2 million barrels per day in production cuts beginning in October. Under the plan, more than 500,000 barrels per day (bpd) would return to the market by December, and 1.8 million bpd would come back by June 2025. Increasing supply, without rising demand, will flow through to lower prices.

- We believe crude oil is “looking for low”, with OPEC’s latest announcement likely to send it in search of such a pivot point.

- However, we wouldn’t be surprised to see an oil spike below $US70, which has held the market for the last 3 years.