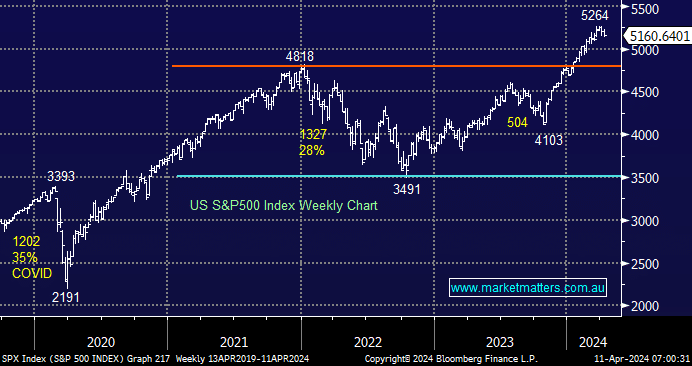

US stocks fell overnight after the strong CPI, which is likely to have sealed the fate of the Fed’s June meeting, with a cut now very unlikely. Two more CPI reports and two Personal Consumption Expenditure (PCE) reports are due out before the Fed’s June policy meeting, but at this stage, it’s 1-0 to the Hawks. With the hope of 2-3 rate cuts in 2024 rapidly evaporating, a huge tailwind for the market and specifically rate-sensitive names is being removed. Hence, a pullback feels increasingly likely.

- We continue to believe US stocks are enjoying a bull market until further notice, but we’re aware that their seasonally weakest period is looming fast – most of us have heard of “sell in May and go away”.

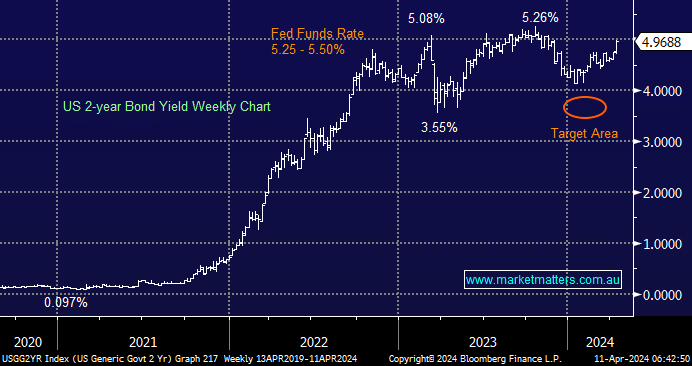

US bond yields surged to fresh highs for 2024 after last night’s inflation data, and they may take some convincing that the Fed is still seriously targeting three cuts in 2024, according to CNN, less than 17% of investors are now looking for a rate cut in June compared to 57% just 24-hours earlier – this shows both the markets latest hawkish shift and how fickle they’ve become on a number by number basis hence we expect volatility to increase through 2024, in both directions as the market second guesses the Fed.

- We are still targeting a retest of 3.75-4% by the US 2s. They look destined to break above 5%, which is likely to worry investors.