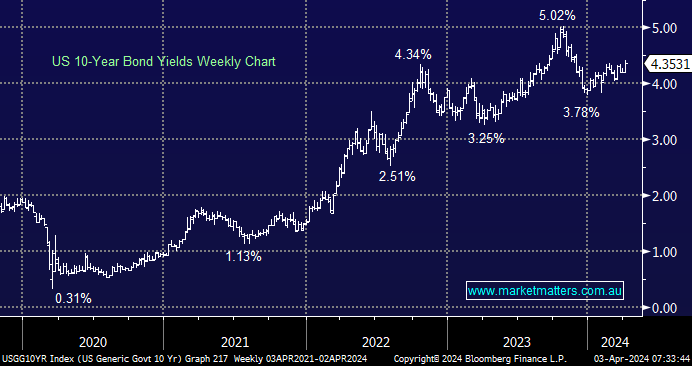

US indices struggled overnight as they digested the decreasing likelihood of interest rate cuts in the near future, accordingly the largest weights on the market overnight came from the rate sensitive healthcare and real estate stocks as US Treasury 10-year yields rose to their highest level since late November. Tesla (TSLA US) caught our eye for the wrong reasons falling -4.9% as the car maker posted lower quarterly deliveries for the first time in almost 4-years – it doesn’t belong in the “Magnificent Seven” in our opinion, it should simply be the “Super Six”.

- We are cautiously bullish around the S&P500 and US stocks, but a pullback is looking increasingly likely after the markets impressive +28% appreciation.

The recent strong U.S. economic reports have increased doubts around whether the Fed can deliver the three rate cuts outlined in its latest forecast – it wasn’t long ago the market was looking for six, now its concerned the Feds too optimistic . Over the last few days the press has again been trotting out “interest rates will be higher for longer” which importantly, is not what equities have been factoring in hence the jitters overnight.

- We can see the US 10s testing the 3-3.25% area through 2024/5 but they’re happy between 4 and 4.5% for now.