Overnight, US stocks recovered from the decline by their futures during our time zone, with the indices largely ending the choppy session unchanged, with energy and healthcare stocks both firm. The S&P5000 has now posted 9 out of 10 positive sessions, a degree of consistency only enjoyed 1% of the time this century, this week will see a plethora of economic data, with tomorrow’s CPI (inflation) and, to a lesser extent the retail sales numbers likely to determine the next twist in the tail for bond yields and subsequently stocks and sectors.

- The NASDAQ looks ready for consolidation after its sharp rally, but we’re still targeting a break of 16,000 in 2023.

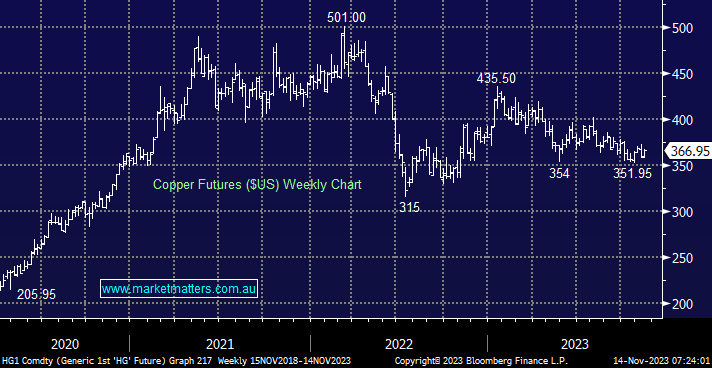

Industrial metal copper enjoyed a rare day in the sun on Monday, advancing ~2.3% as it continues to hold onto the $US3.50 level. It was a nice move on the night but didn’t change the picture for copper as it continues to rotate between $US3.50 and 4.00.

- We believe copper will be trading well above $US4.50 in the coming years, especially once China stabilises its economic ship.