What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The RBA left interest rates unchanged at 4.35% on Tuesday for the 7th straight month, a move that credit markets considered a given before the announcement. However, the accompanying statement from Michele Bullock was hawkish enough to send local bond yields slightly higher:

- The board’s statement began by noting that inflation was still well above target, with stage 3 tax cuts likely to lift consumption later this year.

- After stronger-than-expected inflation figures in April, the RBA board said it “will do what is necessary to achieve” the 2 to 3 per cent inflation target, restoring tough language that has not been used since the central bank’s February meeting

- However, Bullock acknowledged that raising rates would “knock us off the narrow path “ to a soft landing; in other words, they believe hiking rates would trigger a technical recession.

Overall, it was a nothing day for bonds, and there will likely be many more through 2024 as the RBA finds itself in a tight spot until the path for inflation becomes far clearer. The futures market remains concerned about the risks of a rate hike later this year, but our preferred scenario is rates remain at 4.35% into Christmas.

- We see bonds having a decreasing influence on equities through the back end of 2024 as they tread water into 2025.

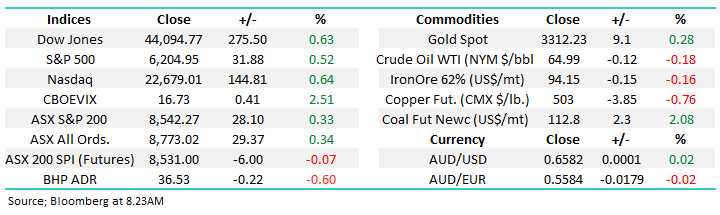

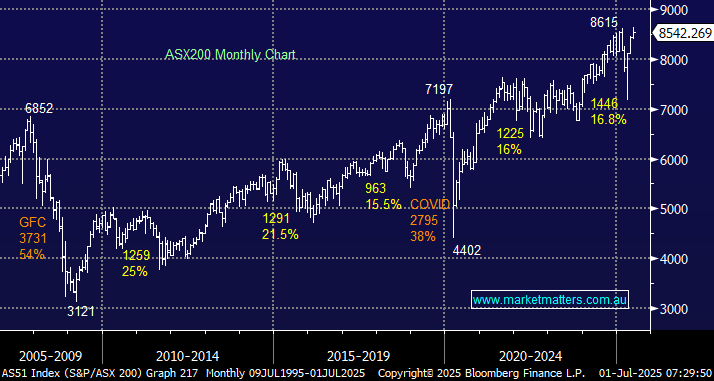

The ASX200 enjoyed a strong day at the office on Tuesday, adding to a solid opening throughout the day to finish up over 1%. Gains were encouragingly broad-based, with over 75% of the main board and all 11 sectors closing in positive territory as sellers appeared to take a lead from the looming US Juneteenth National Independence Day holiday. There were a couple of standout moves that should unsettle the numerous bears who are getting plenty of air time in the press:

- Commonwealth Bank (CBA) made new all-time highs while National Australia Bank (NAB) posted fresh 9-year highs as the Banking Sector continues to ignore the countless overvalued opinions.

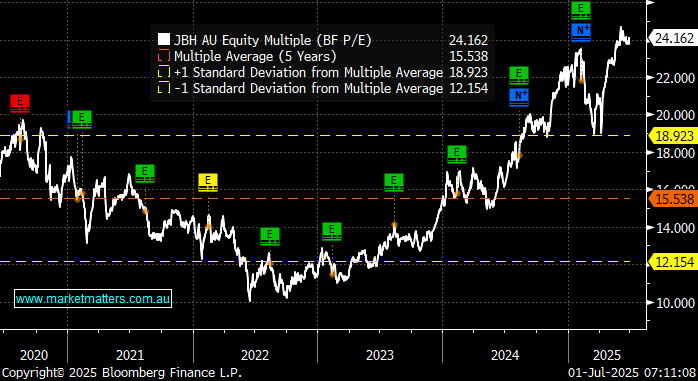

- The retailers were strong, with the likes of JB Hi-Fi (JBH) and Lovisa (LOV) back within striking distance of their all-time highs, only 2 months since the sector was sold off aggressively.

- The Healthcare Sector advanced +1.5% and is looking increasingly constructive; more on this later.

If the Resources Sector can manage to recover even partially, the ASX200 will be trading around the 8000 level in the blink of an eye. As mentioned above, we’ve seen several leading retail stocks rapidly reverse negative sentiment after a sharp decline through April and early May. A couple of further stimulatory moves from Beijing could see the influential large-cap miners enjoy a much-needed bounce, but if/when this occurs is anybody’s guess.

US equities edged cautiously higher ahead of tonight’s market holiday in a quiet session, which saw Nvidia (NVDA US) top Microsoft (MSFT US) to become the most valuable public company. The S&P500 finished up 0.25%, while European bourses continued their recovery, with the EURO STOXX 50 ending up 0.7%,

- This morning, the SPI Futures are set to open slightly lower in line with a ~20c dip by BHP in the US.