What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

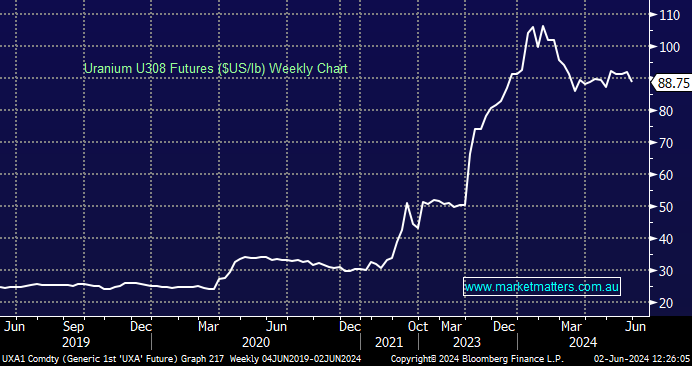

Uranium, the fuel used for nuclear fission, has sprung to the forefront of investor conversation over recent years, sparked by a mammoth 300% appreciation, which began back in 2021. As would be expected, the related stocks have surged accordingly. Interestingly, so far in 2024, when uranium (chemical symbol U) has corrected over 10%, most of the related stocks have kept going. For example, year-to-date Paladin (PDN) is +62%, and Boss Energy (BOE), the “poorer” cousin, is +16%, pretty good returns when the ASX200 is up less than 2%. A couple of points worth acknowledging from this post-COVID explosive move:

- Commodities can often rally or fall far further than analysts expect, especially when there’s a major fundamental tailwind at play.

- Even when the commodities “take a rest”, the related stocks can find ongoing buying into dips in anticipation of an eventual recommencement of the trend.

So far, the first half of 2024 has brought sideways consolidation for U. Many investors expect markets to reverse strongly after surging higher, but a real bull market will simply consolidate its gains. We are starting to believe it will soon resume its uptrend into Christmas, as the stocks imply. On Friday, we saw the US uranium giant (CCJ US) make fresh all-time highs, taking its gain in 2024 to ~30%, an impressive move for a $US24bn behemoth. It’s certainly not paying attention to the current consolidation in the underlying uranium price.

- We have played uranium from the long side through 2023/4 and made money, although we sold our last position in the Active Growth Portfolio too early. We are currently considering again increasing our exposure – MM is currently long PDN in our Emerging Companies Portfolio.

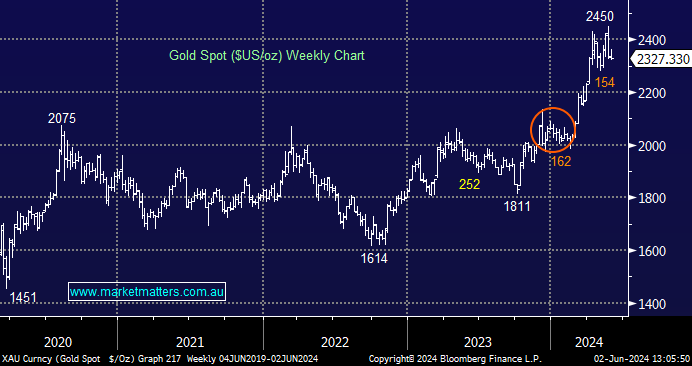

Precious metals have soared higher since late 2023, with gold up ~35% at its best. While it has come off the boil in the last fortnight, as inflation fears resurfaced, the pullback has been relatively tame. We are looking for gold to trade in the $US2300 and $US2550 range into Christmas; in other words, after surging higher since October, we are looking for gold to “take a rest”, just as uranium has the first half of 2024.

- We are looking for gold to consolidate its strong 6-month advance as it did through much of 2023, before again pushing higher.

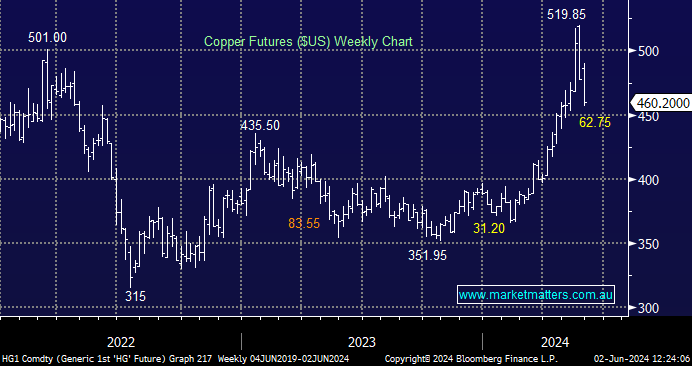

Similarly, “Dr Copper” has soared over 40% since late 2023. Again, while it has pulled back recently as imminent Fed interest rate cuts have largely been discounted, the industrial metal (chemical symbol Cu) remains significantly higher year-to-date. Cu is enjoying the electrification macro-economic driver, but the last fortnight of May had that “blow off top” feel about it as we saw the commodity surge ~10% in a matter of days, garnering headlines across the financial press in the process.

- We expect copper to consolidate its strong six-month advance, as it did in late 2023, before again pushing higher.

At this stage of the cycle, copper and gold are dancing to a very similar tune.

In the case of uranium, we believe that after months of sideways movement through 2024, it’s about breakout on the upside. Conversely, after surging higher over the last 6-8 months, we believe a period of consolidation is close at hand for copper and gold.