What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Last week saw leading EV manufacturer Tesla (TSLA US) plunge over -13% while the tech-based NASDAQ 100 surged to new all-time highs. The shares in Elon Musk’s $US580bn behemoth fell after the company’s earnings missed expectations, and they said volume growth this year “may be notably lower” than was previously expected – this underwhelming demand for EVs, especially in the US, has been the main cause of the weakness of the lithium price and related stocks. The market’s largest concern in TSLA’s report was its outlook, with the stock now down ~23% in January to date.

At MM, we weren’t surprised by the company’s outlook considering the Morning Report we wrote two weeks ago about rental car giant Hertz (HTZ US) selling a large number of its EV fleet and buying petrol replacements, citing higher repair costs and diminishing demand for EVs. The problem over the last 6-12 months has been the lithium price and its related sector were priced for perfection from both the supply & demand sides of the ledger, but alas, reality tells us such perfection rarely exists; in hindsight, a big error on this occasion with the lithium price having plunged well over 80%.

- We cannot get excited towards TSLA, considering its high valuation and the current uncertainties regarding its growth over the coming years.

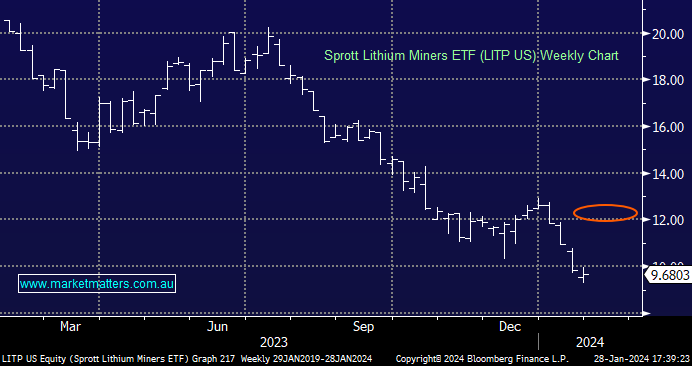

The Sprott Lithium Miners ETF (LITP US) made fresh multi-month lows last week, but it recovered reasonably well, as did a number of local lithium/ESG names – the LITP ETF’s largest holdings currently include Albemarle Corp 11.2%, Sociedad Quimica 10.8%, Pilbara 10.5%, Minerals Resources 10%, IGO 9.6%, and Ganfeng 5.2%. Hence, by definition, with a third of the ETF made up of major local lithium stocks, they are likely to all move as one – MM bought Pilbara (PLS) last week for our Active Growth Portfolio.

- We believe last week saw a classic “panic washout” in the Australian lithium stocks after the banks pulled their funding package for Liontown (LTR).

- We are looking for the LITP ETF to bounce back towards $US12, or ~25% higher, i.e. a good read-through for PLS and MIN.