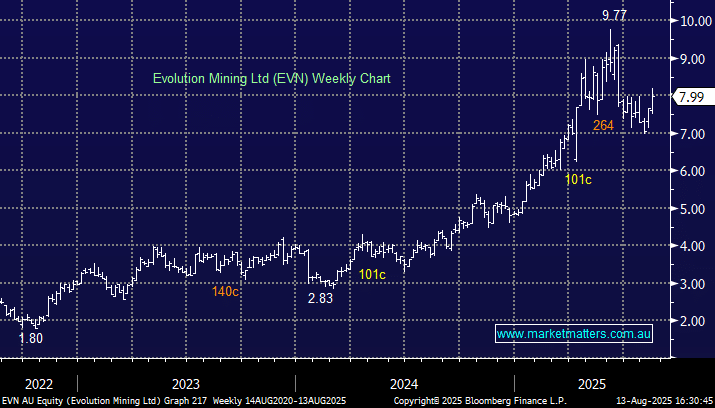

EVN +3.9%: outperformed its gold mining peers on Wednesday, jumping 3.9% after posting a sharp rise in annual profit and more than doubling its dividend. Stronger gold and copper prices and nearly 5% higher gold output year-on-year underpinned the result.

- FY revenue of $4.35bn, up 35% YoY, slightly ahead of expectations.

- EPS of 0.464 up from 0.2915 a year earlier, another slight beat of expectations.

- FY EBITDA of $2.16bn, up 51% YoY.

- The company’s final dividend was lifted from 5c ff to 13c ff.

The forecast FY26 AISC of A$1,720–1,880, versus spot prices around A$5,200, leaves a healthy margin for the gold portion of its revenue. Overall, this was a solid result with no hidden surprises in a market that had relatively low expectations: 1 Strong Sell, 8 Sells, 3 Hold and 4 Buys.