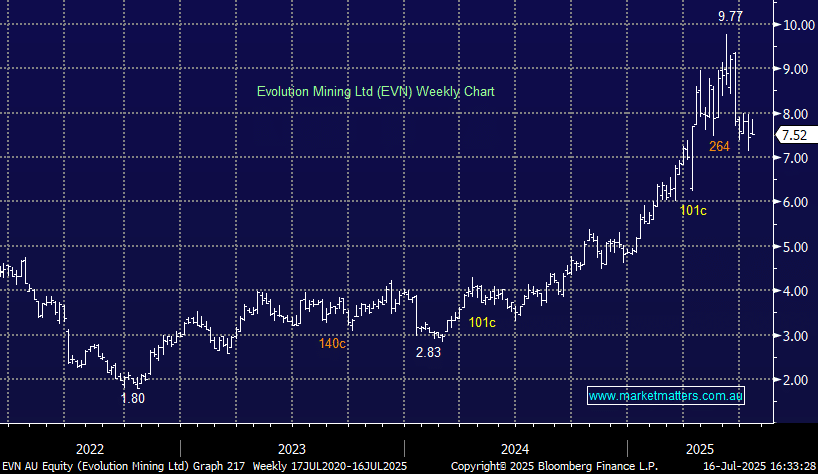

EVN -2.34%: delivered a solid Q4 result, with production and FY26 group guidance broadly in line.

- FY26 gold production guidance of 710–780koz, in line with consensus

- FY26 copper production guidance of 70,000-80,000 tonnes, in line with consensus

- FY26 AISC guidance of $1720–1880/oz was 11% above consensus, ~15% higher YoY

Higher FY26 cost guidance was a notable negative in the result, though it’s being driven by inflationary pressures (~4%) and lower copper by-products which are largely temporary. As site-specific detail comes through in August, we expect the market to refocus on EVN’s improving throughput beyond FY26.

They managed to pay off ~$200m debt during the year, with gearing now back to just 15%, down from 25% last year. Good balance sheet, executing operationally and we think an ongoing commodity price tailwind will see prices rise over time.