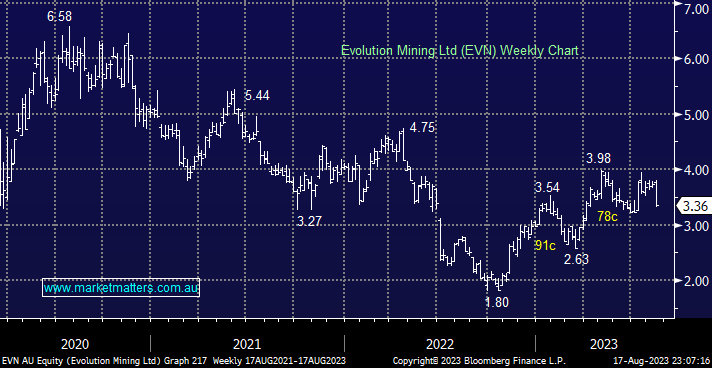

EVN fell -4.8% yesterday following a lukewarm reception to its FY report which saw revenue of $2.23bn up 8% on the year but EBITDA of $844.5mn down 6% and importantly ~5% below expectations with costs and lower copper credits the issue – costs again! Guidance was largely unchanged, expecting cost per ounce to fall on higher production and the benefit of their copper production offsetting higher labour costs which are expected to climb ~6% in FY24. Importantly we still see EVN as a great way to get exposure to gold with the added copper kicker also supported by our medium-term view on the commodity – copper is now ~25% of the company’s revenue.

- We currently hold 3% of our Flagship Growth Portfolio in EVN, we are considering tweaking this up to 4% if/when we close our NCM position.