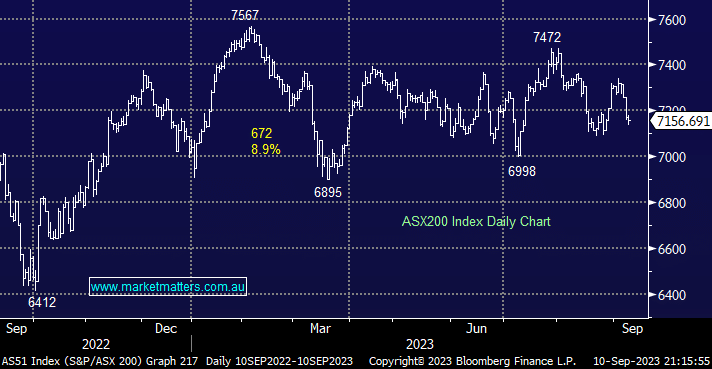

The ASX200 has commenced September in a very inauspicious manner, closing down -2% month to date on Friday, with most of the weakness unfolding in the 2nd half of last week in the Tech, Consumer Discretionary and Materials Sectors. The local market has been trading in the same range for over 2-years, and we see no reason to fight this trend with our focus firmly on stock/sector rotation to add value (alpha) until further notice. At this stage of the cycle, we are focusing on whether Beijing can reinvigorate China’s economy to breathe some life into the Australian miners, followed further down the track when the Healthcare Sector will start to show some strength.

- The SPI Futures are calling for the ASX200 to edge higher this morning.

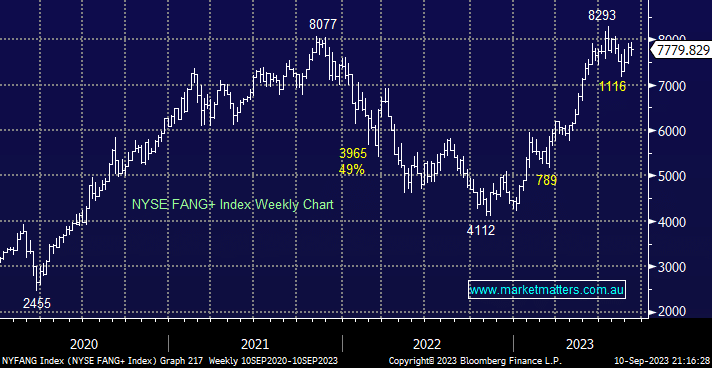

The US Tech Sector continues to follow the MM roadmap, and if we are correct, it’s commenced the next leg to fresh all-time highs, but it’s important to remember that MM is planning to reduce our tech exposure into such strength. The current interest rate concerns have slowed the ascent. Still, some tepid economic data over the coming weeks &/or a bounce by Apple (AAPL US) and our target could easily be achieved before the end of October. Still, it’s important to note the risk/reward is no longer exciting for the bulls.

- We remain bullish on the NYSE FANG+ Index (tech), initially targeting the ~8500 area, only 6% above Friday’s close, even after Apple’s wobble last week.

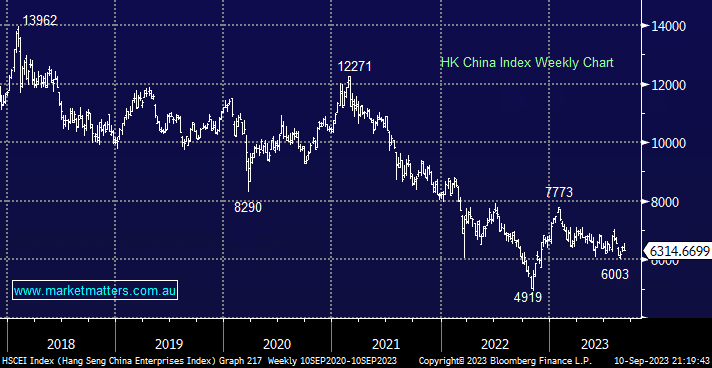

Chinese facing stocks drifted lower last week as no further meaningful stimulus was forthcoming from Beijing. However, with the HK China Index still well over -50% below its 2018 high, we like the index in the 6000-6500 area. We continue to believe that Xi Jinping will improve their struggling economy with further targeted stimulus, and we should remember that Western economies have shown us the inflationary risks that come with bazooka-style stimulus.

- No change; we like the risk/reward toward China facing equities into weakness.