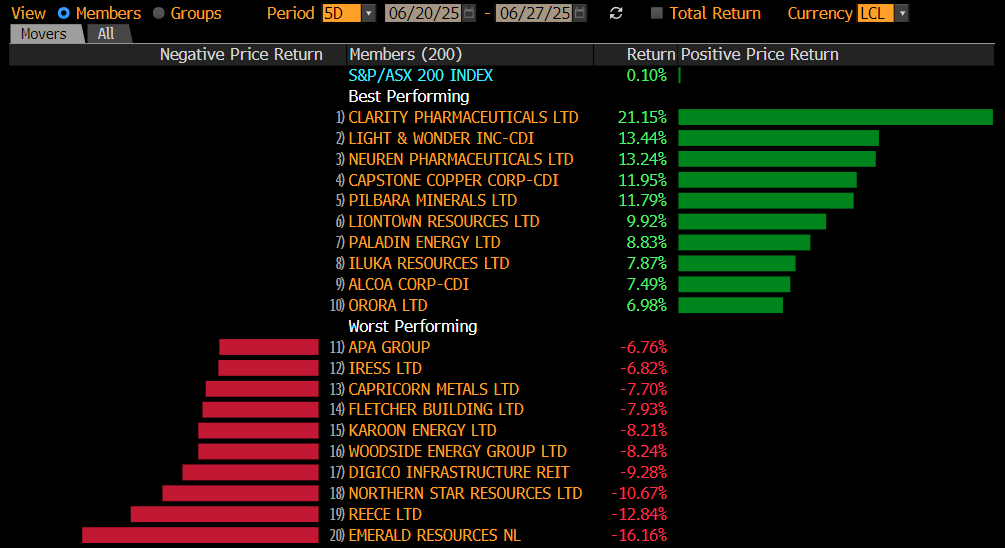

The ASX200 is set to open back above 7000 this morning, with a 40c advance by BHP Group (BHP) in the US set to be supportive early this morning. The Friday night rally in the US was headed by a surge in big tech aided by a relatively calm session across bond markets as investors enjoyed a lack of major surprises from Fed speakers – the “no news” path of least resistance is higher for US indices.

- The SPI Futures are pointing to a higher opening this morning, up around +0.32%, following a solid broad-based Friday night on Wall Street led again by tech.

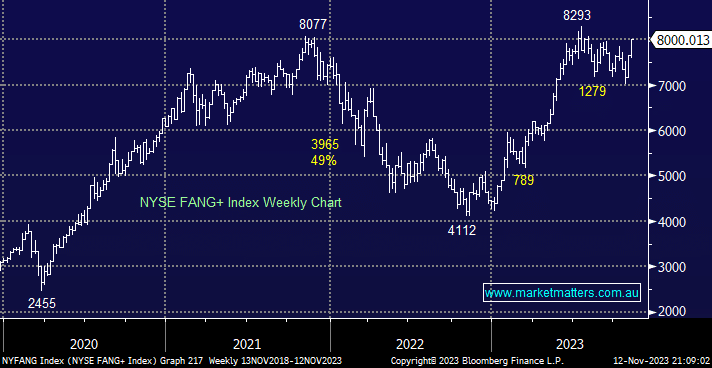

US stocks closed firmly last week, with the influential FANG+ Index now at a 7-week high, less than 4% below its all-time high, an excellent reversal of fortunes following the weakness through September/ October. Our preference remains for a break to new all-time highs into Christmas, but this is no longer a big call. With the likes of Apple Inc (AAPL US), Microsoft (MSFT US), Amazon.com (AMZN US) and Meta Platforms (META US) all advancing over +2% on Friday, the upside momentum looks and feels very healthy.

- If the FANG+ Index follows the MM roadmap, it will make new all-time highs over the coming weeks/months.

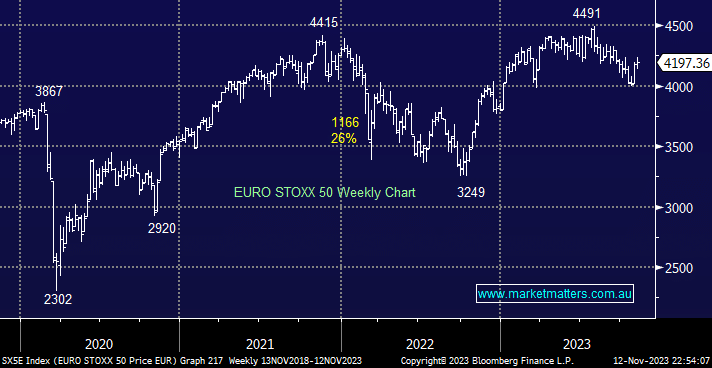

The European EURO STOXX is only 6.5% below its all-time high posted on the last day of July; our preference is for a grind higher into Christmas as opposed to the explosive move enjoyed by US Tech – theoretically a bullish read-through for the highly correlated ASX.

- We can see the EURTO STOXX 50 breaking 4500 into 2024, but we wouldn’t chase strength at this stage.