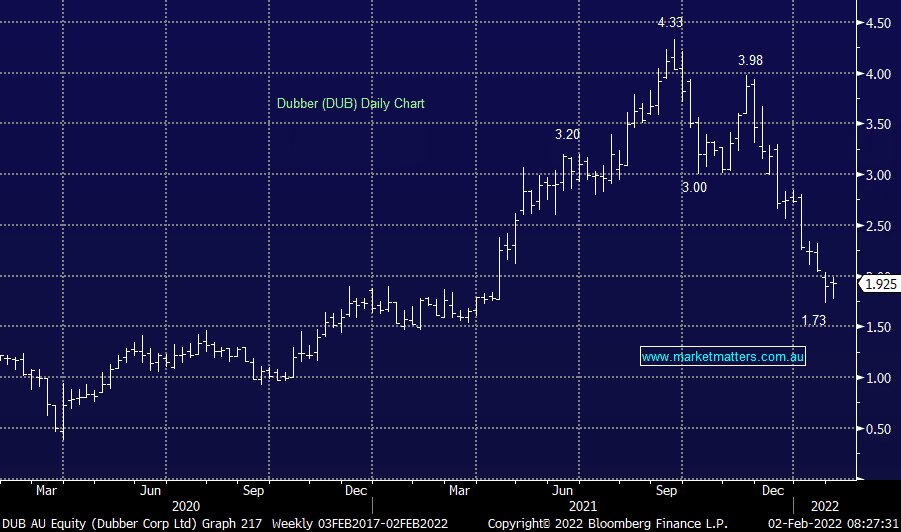

One stock we added to was Dubber (DUB) which was also out with a quarterly update. We caught up with management following the update with some of the key takeaways being:

- Average Reoccurring Revenue (ARR) growth remains solid, adding $8.3m in the quarter. There’s little reason to believe this will slow down, sales execution has been solid with penetration of existing partnerships growing and they are continuing to grow the addressable market – more partnerships with Telcos and cloud communications providers including a landmark deal with British Telecom (BT) late in the quarter a sign of this momentum.

- Revenue came in at $8.5m for the quarter alone, up 98% YoY. This was only $400k above the prior quarter though, however there has traditionally been a lag between ARR growth and revenue kicking in.

- The main concern from the market was the difference between the revenue line and cash receipts at $5.6m. Management said this was not out of the ordinary with many customers delaying payment particularly in Q2.

- They have a cash balance of $108m, about 20% of their market cap! This is huge for a small cap and it wouldn’t be farfetched to expect another tilt at some M&A, or at least they are well-funded for growth.

- Dubber are now starting to talk about operating cashflow breakeven levels as operating leverage kicks in.