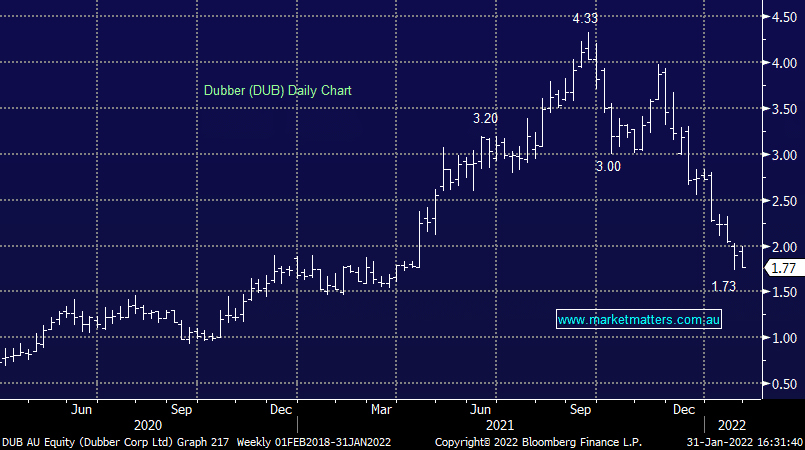

DUB -6.84%: started well however the cloud based communications business rolled off into the close following the release of their 2Qtr results. Average Reoccurring Revenue (ARR) jumped over to $50m for the first time with the fastest net add rate on record with organic growth of 19% in the quarter alone. ARR nearly doubled in the last twelve months and with operating costs only marginally higher there’s a clear path to being operating cashflow positive, potentially by the end of the year. They continue to pen new partnerships & secured 2 acquisitions that will also bolster ARR & their unique offering to customers. The negative market reaction seemed to be a result of a miss to cash receipts following a delayed payment from a large customer – however these issues should pass and we are confident in the direction being taken by the company.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM continues to like DUB despite SP weakness

Add To Hit List

Related Q&A

Dubber Suspended!

MM’s thoughts on PBH & DUB

Update on 4 emerging company share positions

Question on sentiment & AD8/DUB

We are bullish Dubber (DUB)!

Thoughts on Family Zone (FZO)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.