DRO has recently entered the ASX200, as its market cap soared to an eye-catching $5bn, for a company only just profitable. In the 1H25, DRO reported revenue of $72.3mn, up over 200% YoY, which dropped down to a profit (NPAT) of $2.1mn. However, this is a growth stock on steroids with revenue set to jump to $245mn in FY26, and $300mn in FY27. To recap, DRO, as its name implies, develops counter-drone and electronic warfare systems that detect and neutralise hostile drones for defence, government, and critical infrastructure customers worldwide. DRO is among the major 7 anti-drone system manufacturers globally, whose growing sales pipeline is a testament to its strong market position.

- DRO has already sold more than 4000 systems worldwide and received orders for $7.9mn from the US defence department this month.

- The company is preparing to commence manufacturing in Europe in the first quarter of 2026, with plans to establish a separate research and development centre of excellence.

This is a case of a business with a quality offering, very much in the right place at the right time:

- The current global unrest, from Ukraine to Gaza, has seen defence budgets surge, with NATO countries estimated to spend $US1.6 trillion in 2025.

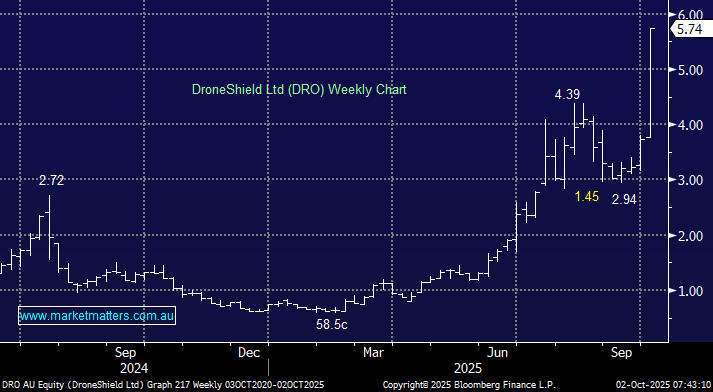

However, the catalyst for the current surge towards $6, apart from forced index/ETF buying, is coming from Europe. On Wednesday, European Union leaders backed plans to bolster the bloc’s defences against Russian drones as they met in Copenhagen days after airspace intrusions by unmanned aircraft over Denmark and Poland. The EU is set to commission a “drone wall” as part of NATO’s broader “Eastern Flank Watch” program, aimed at enhancing defence capabilities along Europe’s eastern borders with Russia and Ukraine. DRO is well-positioned to benefit from this next leg in European spending after securing a $61.6mn European contract in June from a European military customer via an in-country reseller.

- We like DRO, and while its valuation is daunting with the stock trading on more than 150x est. FY25 earnings (Dec year-end), contract wins in Europe for the “drone wall” could rapidly reduce its expensive tag.

- DRO is clearly a volatile stock, having already corrected more than 30% once in 2025, but the narrative is topical and real, but only suitable for investors comfortable to venture into a very hot space that will likely have big swings in the SP in both directions.