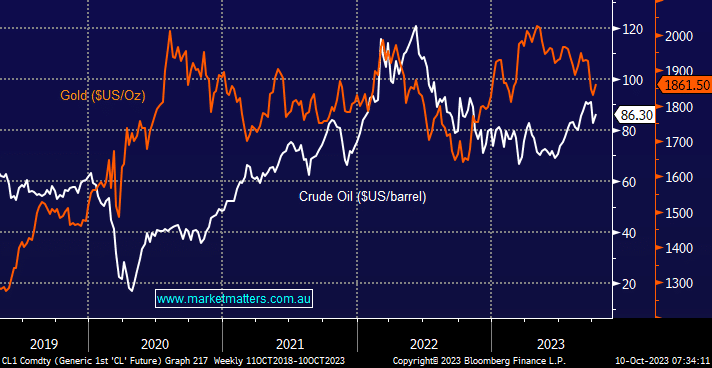

Gold and crude oil have risen due to the conflict between Israel and Palestine and likely prolonged Middle East tensions. Overnight, both saw strong moves on the upside, with gold advancing +1.7% and crude oil +4.1%. We can argue that both commodities look bullish into Christmas, although we feel they are at different stages of their post-COVID advance:

- Crude Oil is only -4.5% below its September high as demand has held up better than many expected despite higher rates, while supply has lost some of the elasticity of recent years. Middle East tensions could easily see curtailed supply which would provide a strong tailwind to oil prices. If we were traders, we could not entertain being short, but as investors, our current plan is to look for opportunities to sell into strength, i.e. crude oil is still ~40% above its pre-COVID level.

- Gold has struggled over recent weeks, retracing ~$US250 as surging long-dated bond yields have taken the lustre from precious metals. We are bullish on gold into 2024, in line with our view that bond yields are set to reverse lower into 2024 weighing on the $US – our overall stance is to buy dips.

We believe gold stocks will outperform oil names into 2024, but for this to prove on point, bond yields will need to stop rising and, in all likelihood, reverse lower into 2024.