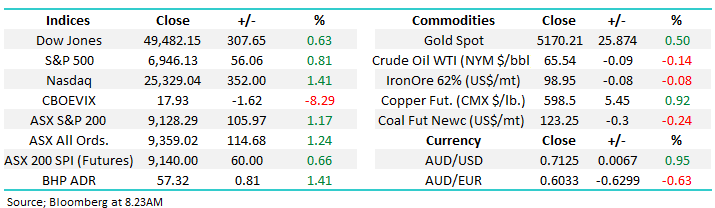

The $US continues to move in tandem with bond yields hence, if we are correct in the 1Q, it’s a buy around 100 and sell nearer to 105. We remain ultimately bearish about the $US, but it has already fallen over 13% from its 2022 high, and a few months of consolidation is our preferred scenario, which implies no negative surprises for equities in the coming months.

- We remain net bearish towards the $US, but some consolidation/volatility feels likely within the 100-105 range.

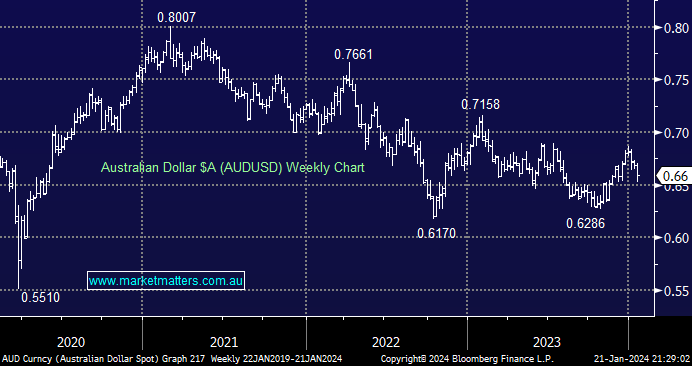

The Australian Dollar remains “heavy” in the basket of currencies against the $US as China weighs on sentiment towards our commodity-linked currency. After reversing sharply lower in 2024, the momentum has moved towards the bears and put MM back on the proverbial fence.

- We are now 50-50 for the next 10% move for the Aussie, with a break towards 60c a distinct possibility.