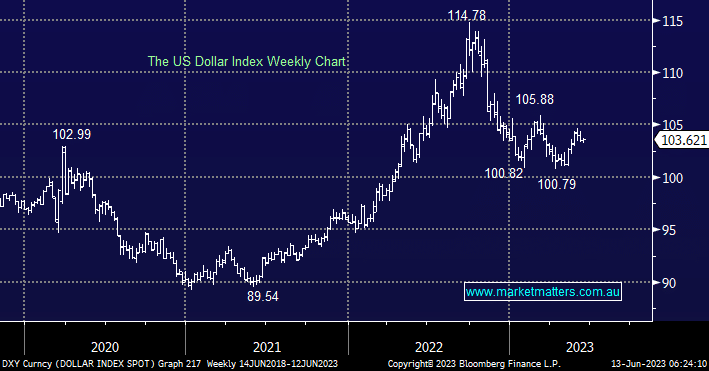

We continue to expect the influential Greenback to rotate in the 101-105 area with the recent rally from Q2 lows consolidating but not in any manner to cause us to deviate from our short-term bullish roadmap. Our preferred scenario is the $US tests the 105-106 area before at least taking a rest on the upside i.e. not much further.

- No change, we believe the $US Index is correcting its 12% drop from the September high, considering the downside move took 8 months to unfold the bounce could still take many weeks to unfold.

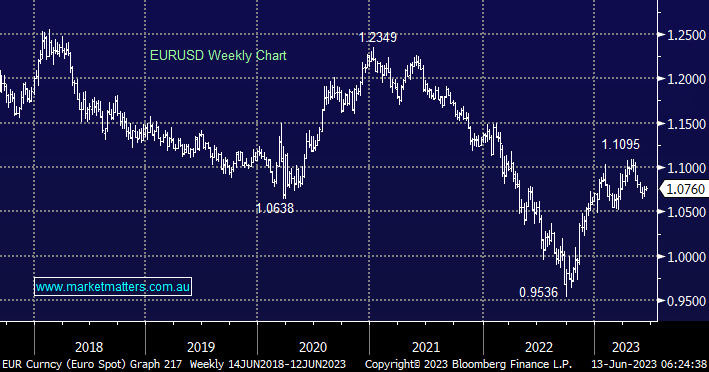

The Euro looks very similar to the $US but in reverse, while we still see further consolidation/weakness over the coming weeks the downside momentum is running out of steam – the read-through being that resources could take another leg on the downside but it’s likely to be when MM will look to increase our exposure to the area.

- We like the risk/reward toward the Euro closer to the 1.05 area.