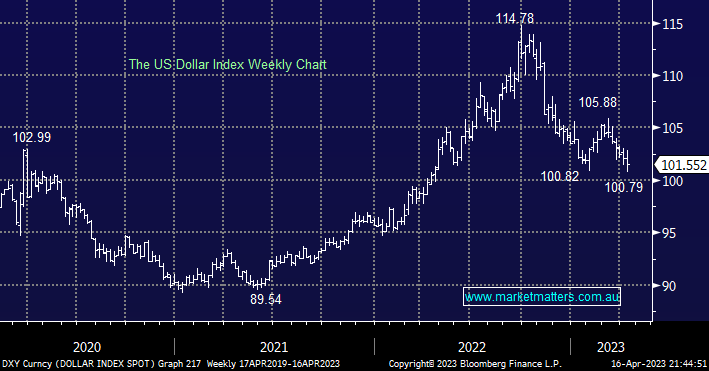

No major change, we now expect the Greenback to rotate in the 101-106 area as the Fed’s rate path becomes the most important focus of FX markets i.e. we believe 101-105 is around fair value until the next economic chapter reveals its hand. At MM we continue to believe the $US is one of the major keys to equities through 2023/4 with it likely to exert a neutral to a mildly negative influence on risk assets if we do see a rotation back towards 105.

- A rotation back towards the 105 area would dovetail with a bounce by bond yields and a pullback in precious metals.

The Euro tested fresh 12 months highs last week as the region became an investment area of choice, similar to our view across bonds and gold we can we see a correction from current levels but we believe it would be one to buy if it does unfold.

- We can see the Euro back below towards the 1.05 area over the coming months as it takes a rest on the upside.

- From a risk/reward perspective we like this European currency into fresh 2023 lows and would not consider being short aka gold.