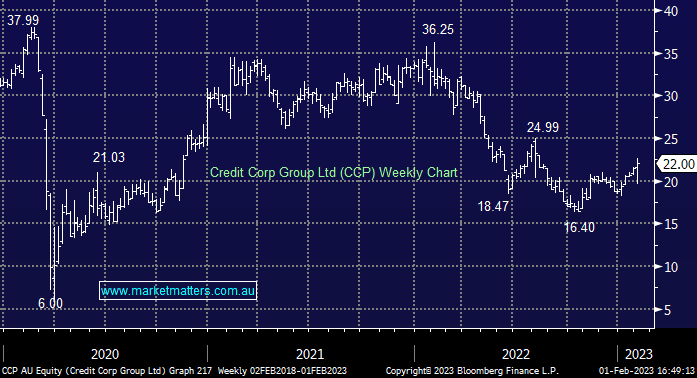

CCP +1.66%: 1H report for the debt collection company was out this morning with the stock initial negative reaction overrun by the session’s end. Net profit for the half fell 30% to $31.8m on the back of US restructuring costs and higher provisioning. These costs are likely to unwind into the second half, with provisioning seemingly conservative at this stage. CCP has struggled to buy debt ledgers given the current health of debts globally, however this has also helped recoveries. The company stuck to full year NPAT guidance but lifted their ledger investment highlighting the need to pay up here.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral CCP

Add To Hit List

Related Q&A

TYR SCG CCP & RMD

Your thoughts on TYR, MFG & CCP please

MM’s thoughts on CCP, CHC & GMG?

MM’s thoughts on CCP, CCX & CHC v GMG

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.