CCP’s business model is to buy bad debts at a discount and collect them for a profit, while also offering collection services to lenders. It’s a specialist in managing and monetising non-performing loans. CCP experienced a significant downturn in FY24 due to market conditions and US asset impairments, but the company has rebounded in FY25 with improved financial performance and optimistic projections for the future, although the markets are not convinced.

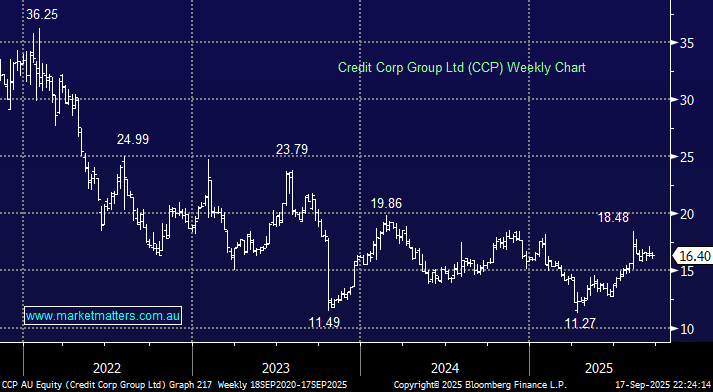

When CCP reported in August, the stock shot up +16% but we said at the time, “it was a solid result but not one for us ~$18”; however, around 10% lower, the risk/reward is improving. The stock is trading on 10.6x FY26 earnings, around 30% below its usual level, with concerns around the challenges related to its U.S. market exposure, offsetting recent resilience in operations. We think the market could be underestimating CCP’s ability to turn around its business from here, with debt opportunities both at home and abroad likely to improve if employment figures deteriorate further.

- We like the risk/reward towards CCP around $16 and can see CCP testing $20 in the coming year, or ~20% higher.