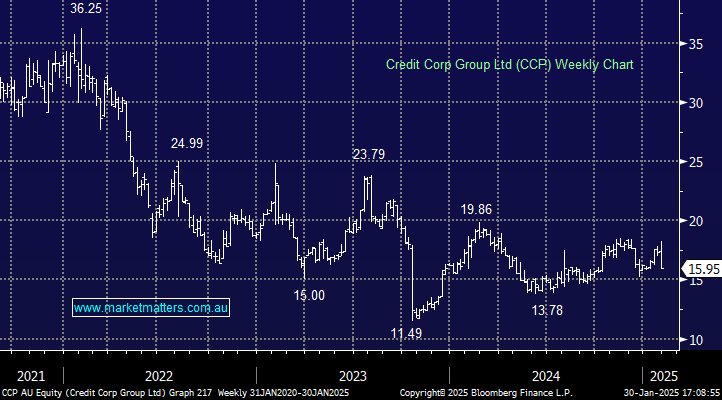

CCP –12.55%: Reported half-yearly results, hitting the mark on revenue but disappointing on the earnings line:

- Net profit after tax $44.1m vs. $47m consensus

- Revenue of $271m vs. $269m consensus

- 5% growth in lending book to $465m

The stock has been a serial disappointer when it comes to results announcements with the share price moving ~20% lower in the month following results 4 times in the last 3 years.

The business reported well in FY24 and appeared to be turning a corner but clearly the market was expecting too much. The business’ earnings growth is reliant upon buying appropriate debt – it hasn’t added to its pipeline of debt purchasing in the first half which reduces their inventory. Whilst it’s positioned to deploy $150m in the coming months we won’t see this flow-through to the bottom line until FY26.