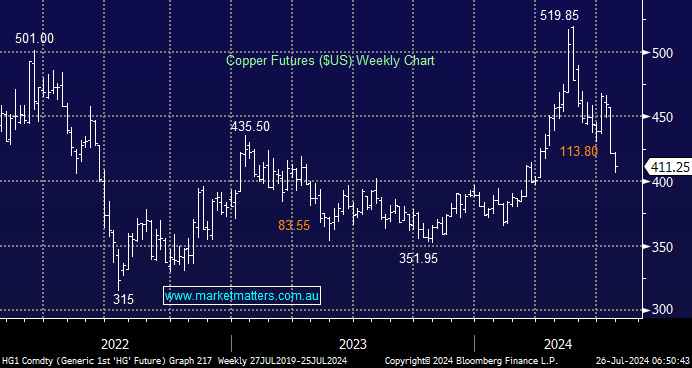

Industrial metal Copper (Cu) was the top commodity pick for most analysts at the start of 2024, including ours. Cu enjoyed phenomenal gains in the first half of 2024 before plunging over 20% as China’s economy slowed, leading to growing inventories, and EV sales continued to disappoint. We remain bullish despite current weakness, but the market has fallen further than MM expected. We should have guessed a top was close when BHP bid for Anglo American (AAL LN) in late June, i.e. corporate action often occurs near price extremes in the commodities space.

- We continue to like the demand picture, but it’s hard to gauge how long the current panic selling will unfold.