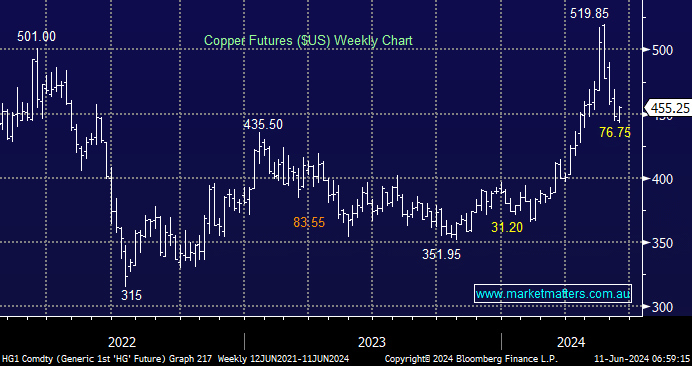

Dr Copper surged higher at the start of 2024 only to pull back 15% over the last 3 weeks, a classic case of too much too soon on the upside. We often refer to short-term moves by financial markets as “noise”, which appears to be the case with this industrial metal, but the tailwind from global electrification, as we strive to attain a cleaner planet, is set to push Cu significantly higher. The final piece of the puzzle to take copper and other industrial metals higher is China, the world’s largest consumer, which is still labouring under the weight of a property crash.

- Based on simple supply and demand fundamentals, we believe copper will trade higher over the coming years—we like it around current levels.

- In the short-term, swings in sentiment around rate cuts are pushing Cu price around, i.e. the industrial metal reacts positively to increased hopes of rate cuts, all else being equal.

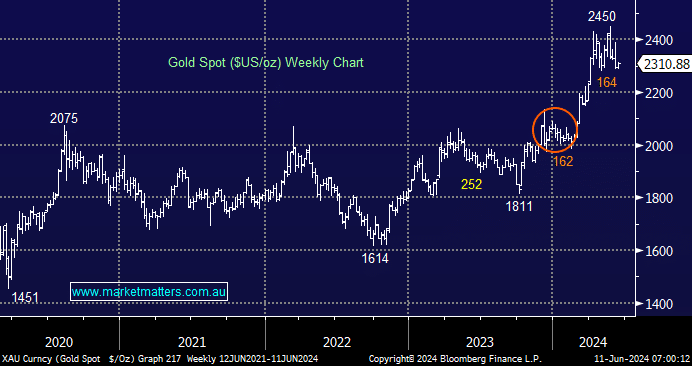

The gold price is directly correlated to bond prices and, hence, inversely to yields; as we see strong economic prints such as Friday’s job numbers, it creates a headwind for rate-sensitive precious metals. As mentioned previously, bonds are starting to edge towards the pessimistic enclosure when it comes to cuts, which suggests gold and silver should find support after slipping ~6% over the last few weeks.

- We believe gold is offering good risk/reward below $US2300 as it consolidates recent gains in the face of interest rate jitters.