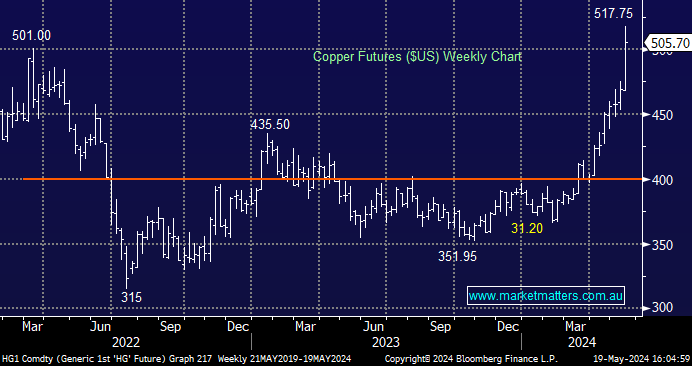

Copper exploded higher last week, but even after the substantial gains, we remain bullish moving forward. Friday’s +3.6% advance saw copper ETFs up ~4.7%, illustrating many investors aren’t still chasing their tale on this theme. Analysts are generally behind the curve when it comes to commodity prices, and we believe there’s never been a better example than copper today, with many forecasts closer to $4 than $5, let alone the $6 that may be on the horizon, i.e. MM believes upgrades are inevitable.

- We are bullish on copper. Although a few weeks’ consolidation may be near, the trend remains up, and surprises usually unfold with the trend.

Last week, silver surged to fresh post-COVID highs, with Friday’s +6.5% move the backbone of the advance. We have no interest in fading this breakout across precious metals, with surprises likely to remain on the upside.

- We believe silver and gold can continue their advance through 2024, with bond yields and the $US set to decline, providing a major tailwind.