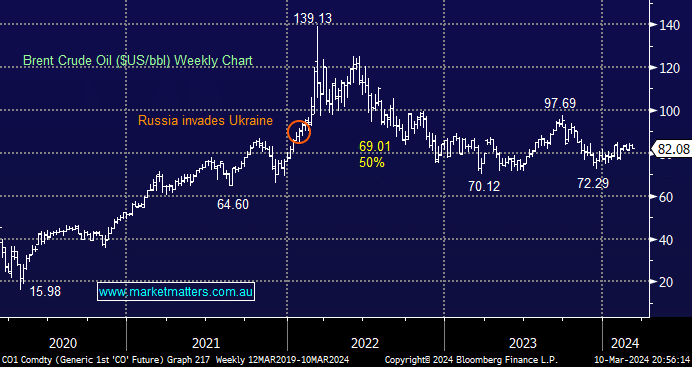

Oil prices have been rotating around the $US80 area through 2024 in a reasonably tight range. Last week, the market weighed up support from Wednesday’s oil report, which showed a smaller-than-expected US inventory increase. This can be interpreted as demand increasing against ongoing concerns that the Chinese economy will continue to struggle. If we are correct and there’s a strong possibility that we see at least a test below $US70, the implication is that Chinese data won’t improve anytime soon.

- No change, we had been looking for Brent Crude to rotate between $US65 and $US85 through 2024, with a downside spike still a distinct possibility.

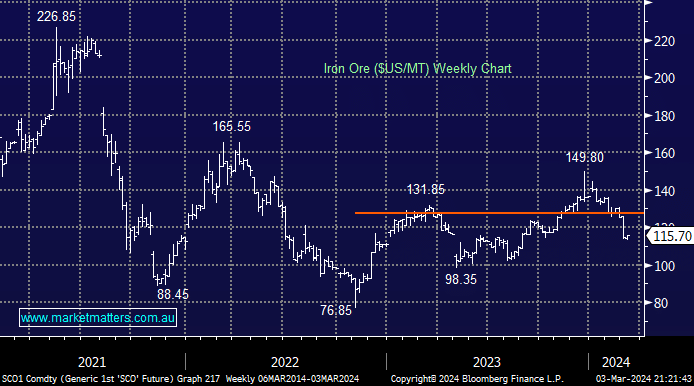

Last week, iron ore managed to arrest its recent decline, although it was not much of a bounce, and the major miners continued to slip lower, but it should be noted that the likes of BHP & RIO traded ex-dividend last week. China is the largest global consumer of iron ore, and its imports increased by over 8% in the first two months of 2024 as steelmakers restocked to satisfy production requirements. Still, it’s been a muted story since the Lunar New Year holiday, as demand has failed to meet expectations. Some companies have limited their purchase of the bulk commodity, preferring to adopt a wait-and-see approach.

- No change, we have been looking for Xi Jinping et al. to successfully lift their economy through ongoing targeted stimulus, but the market remains a non-believer.