Property fund manager CHC surged +15.79% on Wednesday after delivering strong guidance for FY25 for earnings and distributions. The advance sent the stock to fresh 18-month highs, making it the second-best ASX200 stock on a big day of earnings numbers. CHC delivered 2024 earnings slightly above estimates while flagging a healthy 6 per cent rise in distributions in the coming year. The solid result, combined with strong forward guidance, saw the stock re-rated from the opening bell:

- FY24 revenue came in at $597.8mn, down 31%.

- Operating earnings of $358.7mn, down 19%, but still slightly ahead of guidance.

- CHC sees FY25 operating EPS after tax of ~79c and distributions of 45.1cents, a ~10% beat to consensus.

- CHC announced they anticipated distribution growth per share of 6% in FY25 – major positive that grabbed the headlines.

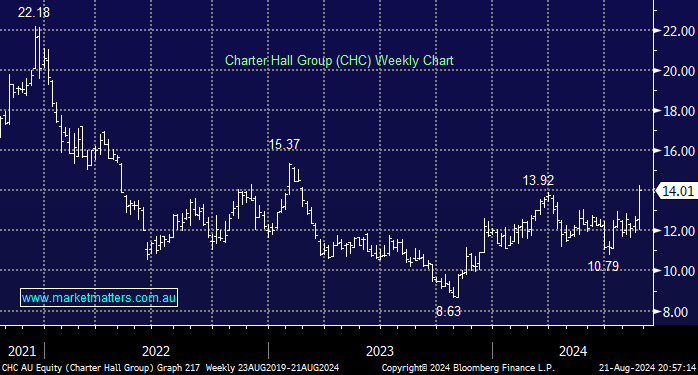

This was undoubtedly a solid result in a particularly skeptical market amid a broader trend to write down the value of commercial properties, and the stock popped accordingly. Most metrics looked better than feared, highlighting that Charter Hall is managing this downturn well. Strong rental growth has largely offset the impact of rising cap rates over the past four years. We continue to like the overall sector, especially with the RBA set to cut interest rates in 2025.

- We like CHC moving forward, but it’s not our favourite real estate pick from here.