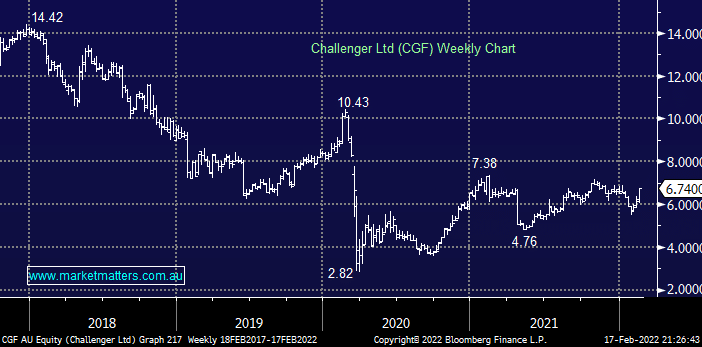

Annuity investment firm CGF rallied strongly yesterday to close up 6.7% after reporting a 21% lift in NPAT to $238mn for the 1st half year. This is a noxiously complex business to analyse and frankly, they’ve dropped the ball a number of times in terms of the portfolio skews they use / risk they take on to underpin their written annuities – it’s not an easy business but it can also be a good one if they get it right. With no immediate fundamental concerns on the horizon CGF is starting look attractive after its tough few years, we believe the next 15-20% is probably up but MM is unlikely to appear on the share register.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish CGF looking for a break of 2021 highs

Add To Hit List

Related Q&A

MM views on CGF and CEH and global supply chain impacts of exploding electronic devices.

How does MM see Fortescue (FMG) trading through 2022?

Picking a healthcare winner

Technical thoughts on CGF & HLS

Our view of Challenger (CGF)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.