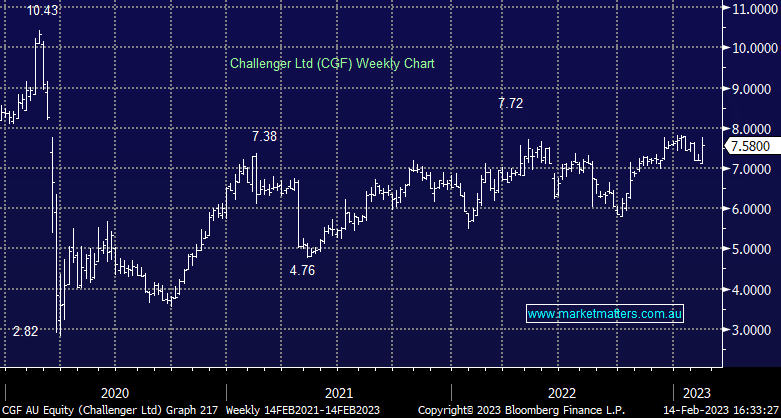

CGF +4.41%: the investment manager posted a reasonable set of 1H numbers, headlined by a small beat at the profit line as higher interest rates create a tailwind for their core annuity offering. Net Profit Before Tax (NPBT) was a small beat at $250m, though the statutory number missed on weak investment outcomes. The Life business was key to the beat with strong sales coming through in the half. Their Funds Management arm was weaker than expected though, however, this is a small portion of earnings. Guidance was in line, NPBT for FY23 expected to be $485-535m vs consensus at $517m, the market will be more comfortable with expectations following the strong first half with the bulk of earnings already in the back pocket.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral / positive CGF

Add To Hit List

Related Q&A

MM views on CGF and CEH and global supply chain impacts of exploding electronic devices.

How does MM see Fortescue (FMG) trading through 2022?

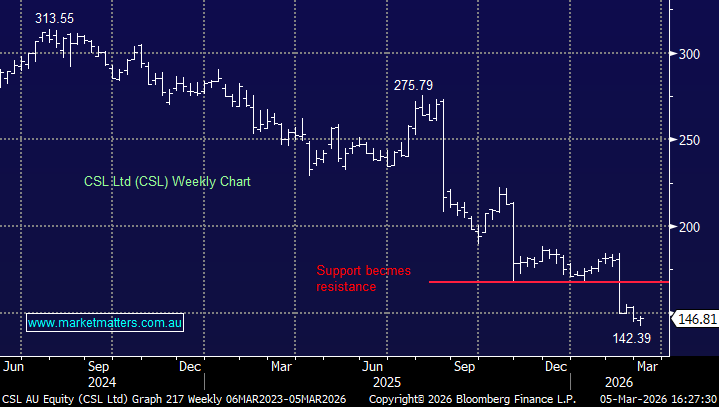

Picking a healthcare winner

Technical thoughts on CGF & HLS

Our view of Challenger (CGF)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.