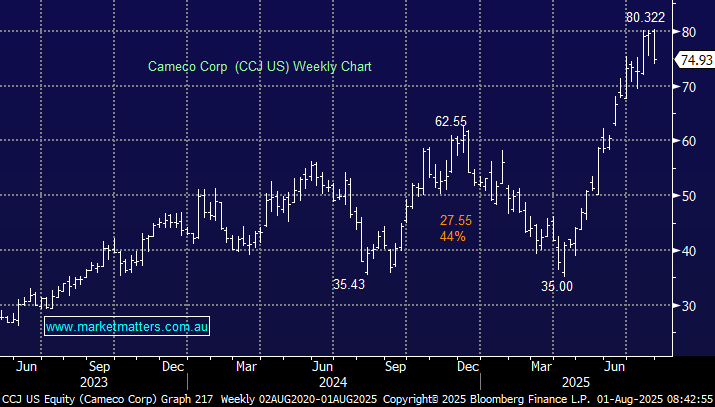

The largest listed western uranium producer, CCJ, slipped overnight after opening stronger following its earnings report. Still, it succumbed to market weakness, plus its +230% appreciation from its April low, which probably led to some understandable profit taking. The Saskatchewan-based uranium miner booked a second-quarter profit of C$321 million, up from C$36 million in the previous year, which we like as a base to move forward:

- 2Q revenue of C$877mn was up 47% from C$598mn, beating estimates.

- 2Q EPS of C$0.71, up from C$0.14 YoY beating estimates.

- Adjusted EBITDA increased to C$673mn from C$343mn.

At MM, we remain bullish on the nuclear theme. CCJ has delivered for shareholders, outperforming many of its ASX peers. We see nothing untoward in this result and are likely to stay long in our International Equities Portfolio.

- We can see CCJ consolidating back towards the $US70 area before making another assault on new highs.