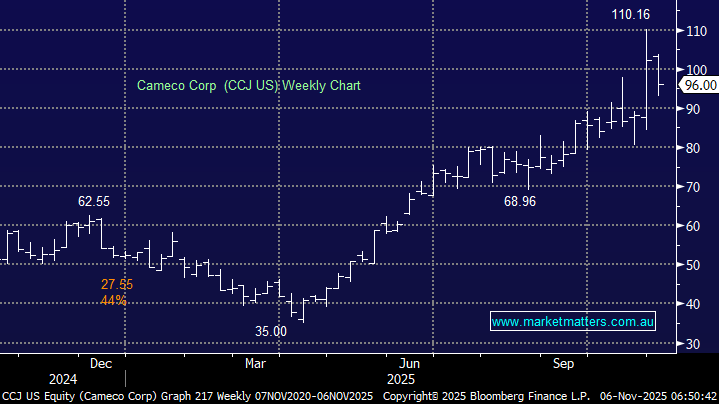

Canadian uranium giant Cameco slipped ~1% overnight after its third-quarter revenue missed estimates, although earnings still rose as the company reaffirmed FY25 sales guidance of $US3.3-3.55bn. The company lifted its dividend as it expects a strong finish to the year, with fundamentals for nuclear energy improving, and it was this optimism that led to a muted reaction to its 3rd quarter miss:

- Revenue: C$615mn v estimates of $C785mn.

- Earnings: Adjusted EPS C$0.07 v estimates C$0.27.

- Uranium average realised price per lb of C$85.22 v estimate C$85.43.

- Now sees uranium production of up to 20mn lbs, v previous 22.4mn.

Cameco and the uranium thematic remains an extremely popular space in the US with 21 Buys, 3 Holds and no Sells on CCJ. This bullish outlook which aligns with MM is easy to comprehend with at least $US80bn of new nuclear reactors to be constructed across the US under a partnership between the U.S. government, Cameco and Brookfield Asset Mgt. in an effort to satisfy AI and data centre demand.