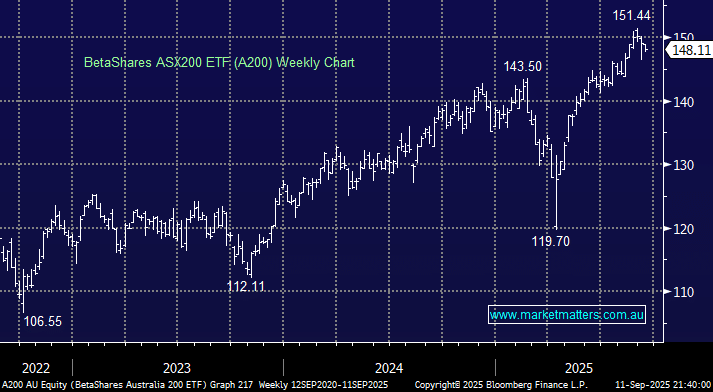

We like the Australian market moving into 2026, which is in line with our bullish equities outlook, especially because of its significant resource weight and high correlation to China, whose economy we believe is turning the corner. Several ETFs offer exposure to the ASX in different forms, but we prefer the A200 ETF due to its ultra-low 0.04% fees.

- The A200 ETF essentially reflects the composition of the ASX200; it currently holds 28.8% in banks, 15.1% in mining, 6.6% in REITs, and 5.6% in Retail.

- The ETF tracks its benchmark, the “Solactive Australia 200 Index” extremely well: Over the last three years, it has gained +12.6%, while its benchmark is up +12.7%.

The market has run strongly, and valuations are elevated, but with rates set to fall and global equities firm, we remain bullish with a potential “Santa Rally” not too far away.

- We like the A200 as we approach 2026: we own it in the MM Core ETF Portfolio.