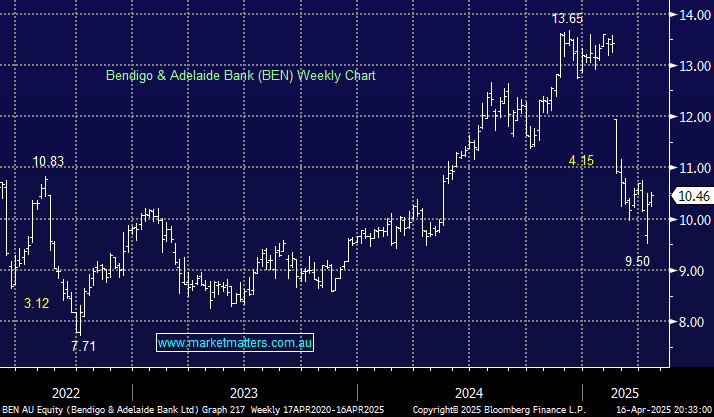

BEN isn’t set to report until August, so investors are left with the poor February result in their minds, which saw a large miss on NIM, very different from BOQ yesterday; this key metric for BEN declined six basis points (0.06%) half-over-half to 1.88%. Downgrades followed, and the stock remains over 20% lower; it needs fresh news to restore confidence in the bank, and that’s not likely this FY. Some people will think it’s cheap and due a bounce, but our take is there’s no need to be there. To put things into perspective, so far in 2025, BEN is down 20.2% while BOQ has advanced +2.4%.

- We aren’t fans of BEN, preferring BOQ in the regional bank space until further notice.