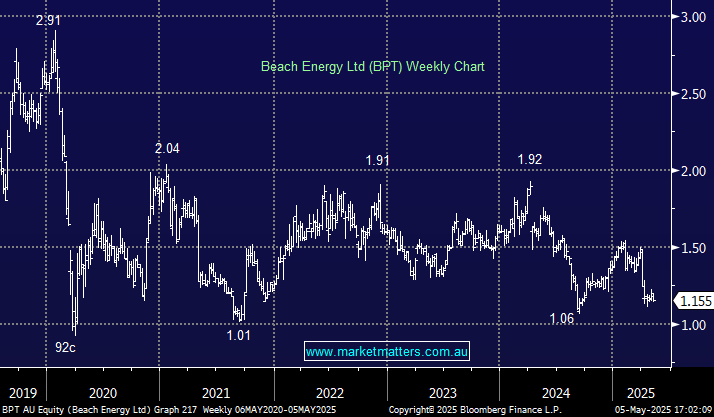

BPT has fallen over 17% in 2025, putting its performance between STO and WDS. This month’s 3rd quarter revenue numbers beat estimates, but construction delays at the company’s Waitsia plant in WA narrowed production guidance, and a higher capital expenditure illustrated diminishing free cash flow (FCF). Sales revenue rose 41% to $552mn, the stock hardly moved on the news, with decisions from OPEC having a greater impact on the share price.

- We can see BPT retesting $1, but overall it’s a coin toss at this stage.