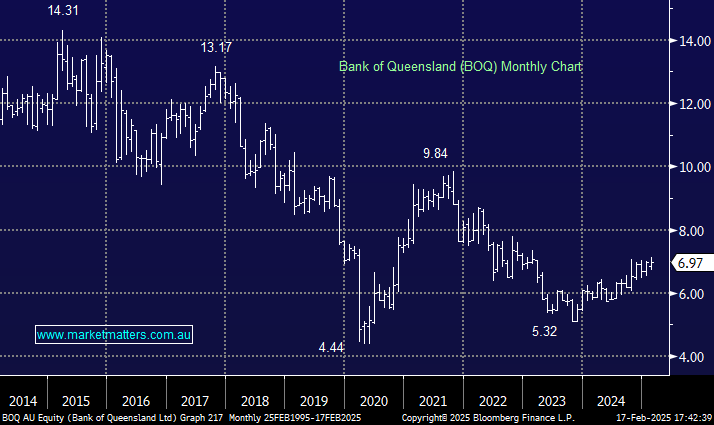

BOQ had underperformed BEN over the last year before Monday’s dramatic unwind, which probably worked in its favour. The QLD regional bank only slipped 1.1%, leaving it largely unscathed from BEN’s report. However, one part of BEN’s result that caught our attention was costs coming in higher than expected due to wage and price inflation, plus elevated IT costs. The latter is one of the reasons why CBA remains the leading Australian bank and a reason for concern with BOQ, as we wouldn’t be surprised to see the fellow regional similarly struggling with increasing IT costs required to try and keep pace with the majors. Scale matters in banking, and this is the reason why we have stayed clear of the regionals in recent years.

- We see no reason to buy BOQ until further notice.