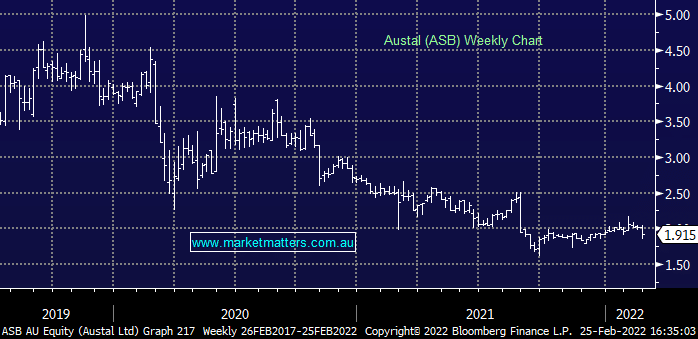

ASB -1.54%: Released their 1H22 Result that was all okay, earnings slightly better than expected despite a 14% drop in revenue but that was a result of some releases of risk contingencies so the 2H will be weaker. That said, the key for ASB is all about winning major US Navy shipbuilding contracts and they believe they are well positioned and that ‘there are a lot of opportunities out there for us to go and win’. Some patience needed on this one.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM own in our Emerging Companies Portfolio

Add To Hit List

Related Q&A

Q&A for Sat Weekend report – ASB & XRO

Thoughts towards Austal (ASB)

Thoughts on ASB after its downgrade?

Thoughts on Capitol Health, Austal and Standline Resources?

Austal (ASB) – is it a buy?

Is Austal a takeover target?

Austal (ASB) share price decline

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.